Alternative data: Apple case study

Apple ($AAPL) unveiled not one new version of the iPhone X, but three, in its biggest event of the year.

Among the trio is Apple’s largest ever phone – the iPhone Xs Max – which features the biggest display that Apple has ever put in a phone.

Many details about that new phone, including its shiny gold color, were accidentally leaked by Apple ahead of the event. The other two devices are the slightly smaller iPhone Xs and the cheaper iPhone Xr.

“iPhone XS is packed with next-generation technologies and is a huge step forward for the future of the smartphone. Everything is state of the art including the industry-first 7-nanometer A12 Bionic chip with 8-core Neural Engine, faster Face ID and an advanced dual camera system that shoots Portrait mode photos with Smart HDR and dynamic depth of field,” said Philip Schiller, Apple’s senior vice president of Worldwide Marketing.

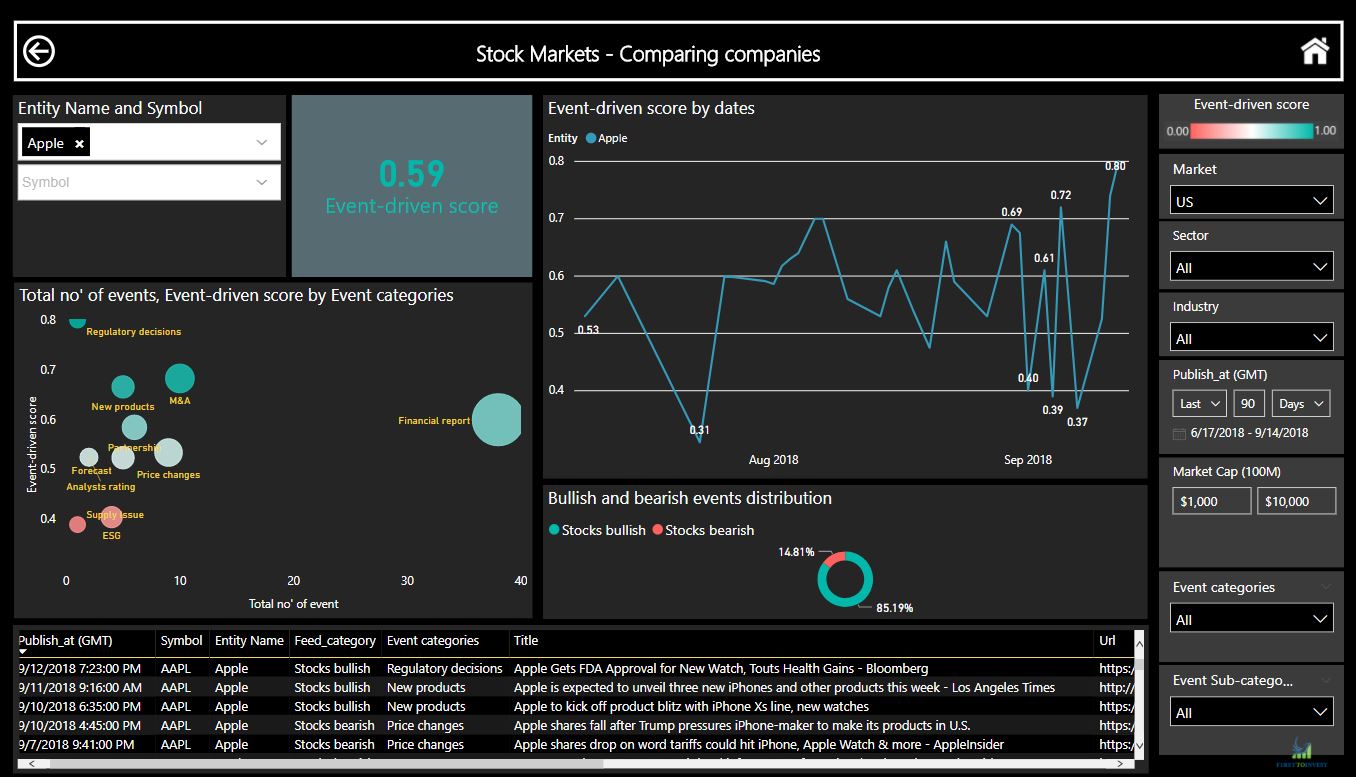

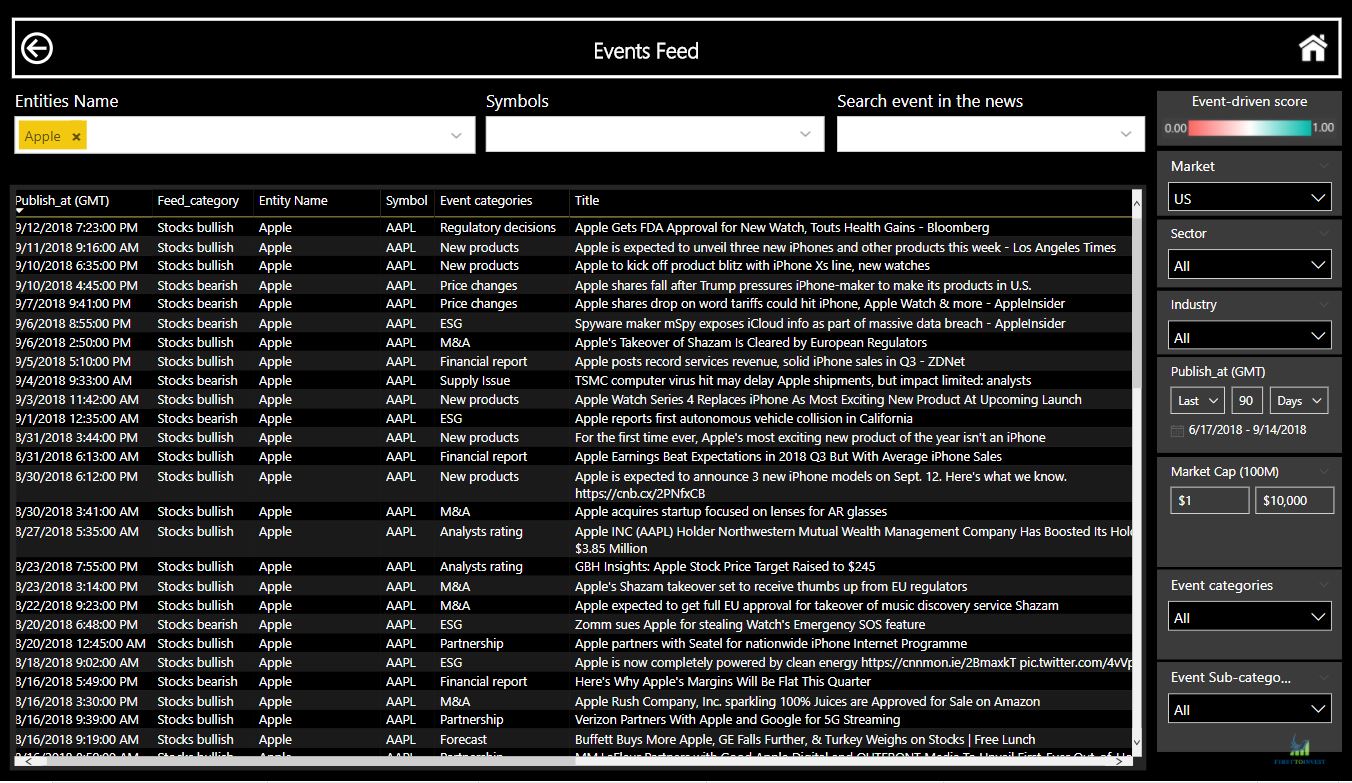

The latest company event was an important event for the company but its only one corporate event from many. During the past months, Apple is facing huge pressure from Trump to produce Apple’s products in the US, which will increase the products’ prices. Moreover, the iCloud was in the middle of a massive data breach. These are a small sample from 25 events related to Apple during the past 90 days.

.

(event-driven score is scaled between 0-1 where bellow 0.5 points to a bearish event-driven score based on events during the filtered period, above 0.5 points to bullish event-driven score) clicking here to trial our system

Apple had 10 event categories such as financial reports, M&A, regulatory decisions, ESG, new products, New partnerships, potential supply issue, analysts rating, and demand forecast. In each category, there are several events which had an impact on the stock price. Monitoring these events helped the decision makers to evaluate the stock more accurately and act as a complementary analysis to the fundamental or technical analysis.

In today’s rapidly changing environment it is essential to be able to track corporate events such as M&A, new deals, partnerships, ESG, regulatory decisions, management and stakeholders changes, expansions to new market or product categories, new products, price changes, new agreements, FDA decisions, financial reports related events, macroeconomics, and much more.

These events are found in traditional financial sources as well as in the social media, however, but it’s critical to use reliable sources to avoid misleading events like the Tesla’s case. To extract, clean and analyze the events, a hybrid model between Human and machine should be conducted to get quality event detection and analysis. Finally, the event data should be streamed to the end user in the most compelling and easy to use methodology to avoid data overload.

To conclude, tracking equities or other asset events can add an edge to new investment decisions, finding new opportunities, monitoring portfolios, mitigating risks, and acting as a complimentary analysis alongside to the traditional analysis.

Using big data and NLP technologies to capture alpha by collecting, structuring, and revealing events from news articles, press releases, and financial social media.

(Views and recommendations given in this section are for research purposes only. Please consult your financial adviser before taking any position in the stock/s or currencies mentioned.) Neither First to invest. nor any of its officers, employees, representatives, agents or independent contractors are, in such capacities, licensed financial advisors, registered investment advisers or registered broker-dealers. First to invest does not provide investment or financial advice or make investment recommendations. Nothing contained in this communication constitutes a solicitation, recommendation, promotion, endorsement or offer by First to invest of any particular security, transaction or investment.)

TAKE THE NEXT STEP