ESG event category – AT&T case study

AT&T ($T) has suffered a data breach that compromised some details of about 3% of its total 77 million users or about 2 million customers which the personal information of millions of its users, including phone numbers, e-mail addresses, and account numbers, were exposed to hackers.

This type of event was classified in the ESG category which has implications on the stock price over the recent years. Recent studies show that there is an increasing usage of ESG event monitoring by the large institutional investors and it will be a mandatory factor in the investment and risk decision making.

The key challenge with the ESG category is that they capture events especially the social sub-category as you need to have a classifier to distinguish between natural text and the events that are found within the text or in the headline.

AT&T ($T) suffered tremendously from this event with a 5% decrease on the share price from the event date until present.

From the AT&T chart, we can see that only three days after the initial announcement the stock price change direction and consistently fell down for 4 trading days. Companies that used event monitoring systems got the opportunity to react or mitigate the risk from this event and act accordingly.

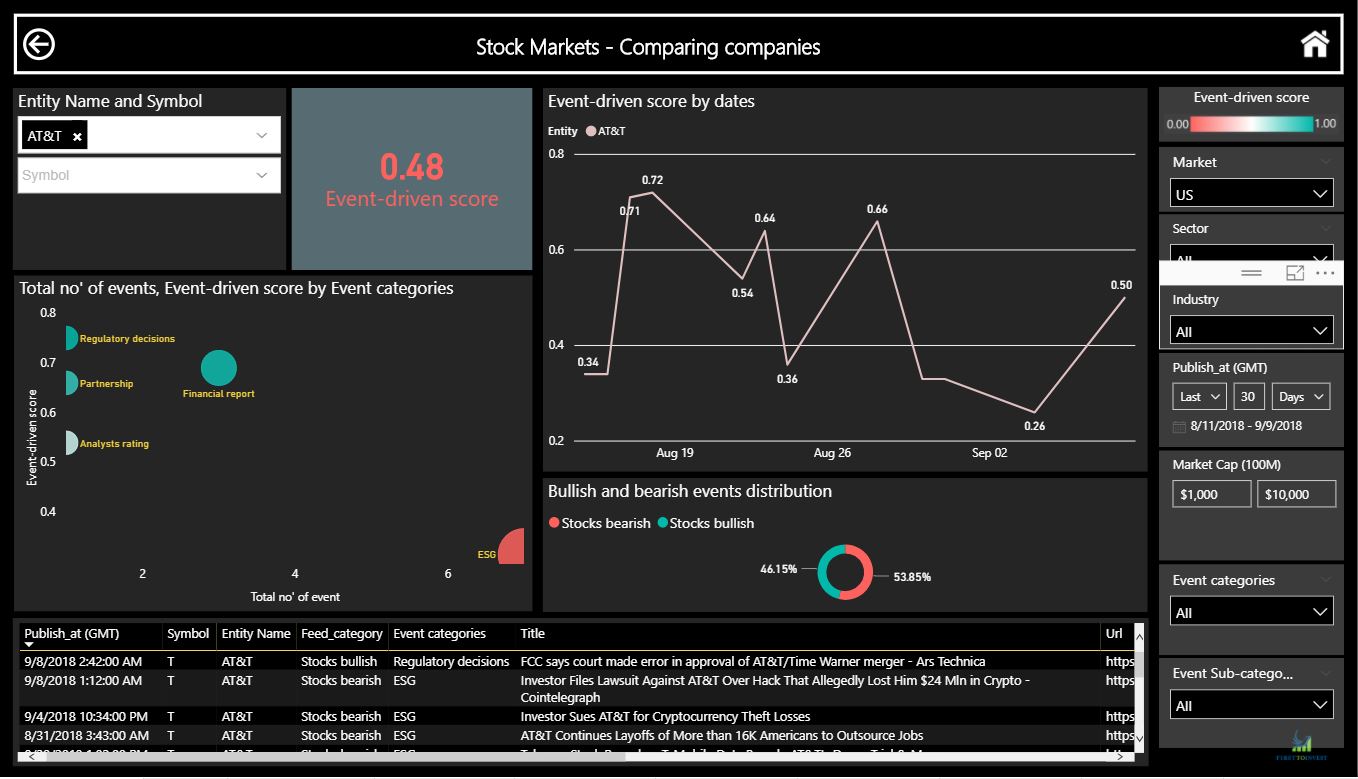

Here is an example of how event monitoring captured the trend before and after the announcement:

(event-driven score is scaled between 0-1 where bellow 0.5 points to a bearish event-driven score based on events during the filtered period, above 0.5 points to bullish event-driven score) clicking here to trial our system

From this dashboard, we can see how the event tracking methodology was able to track the stock price change based on the events that took place during Aug 2018. From this example, we can see how the ESG event category impacts the stock price and how event extracting and monitoring can track the price movements and react to new events.

Another advantage of monitoring the ESG event category and others is found in the risk monitoring practice where companies that suffer from the same bearish scoring event category, tend to be more exposed to volatility than others.

Using big data and NLP technologies to capture alpha by collecting, structuring, and revealing events from news articles, press releases, and financial social media.

(Views and recommendations given in this section are for research purposes only. Please consult your financial adviser before taking any position in the stock/s or currencies mentioned.) Neither First to invest. nor any of its officers, employees, representatives, agents or independent contractors are, in such capacities, licensed financial advisors, registered investment advisers or registered broker-dealers. First to invest does not provide investment or financial advice or make investment recommendations. Nothing contained in this communication constitutes a solicitation, recommendation, promotion, endorsement or offer by First to invest of any particular security, transaction or investment.)

TAKE THE NEXT STEP