Industry analysis – Medical Devices case study

US medical device makers could lose $138 million this year as a result of the 25 percent US tariffs on Chinese imported goods that went into effect from July, and they may cause some manufacturers to downsize and cut research and development.

“We estimate that the imposition of additional 25 percent duties will impact approximately $836 million worth of medical technology entering the US from China, including related component parts and manufacturing materials,” said Ralph Ives, executive vice-president of AdvaMed, a trade association based in Washington.

“These tariffs on imaging products or their components will harm the US medical technology sector’s ability to stay competitive and will adversely affect the US economy in ways that could compromise patient access to care,” said Patrick Hope, executive director of the Medical Imaging and Technology Alliance (MITA).

“The tariffs are estimated to cost American device makers more than $138 million this year. CT scanners and other X-ray device components, in particular, would be most significantly affected, according to the survey results,” Hope added.

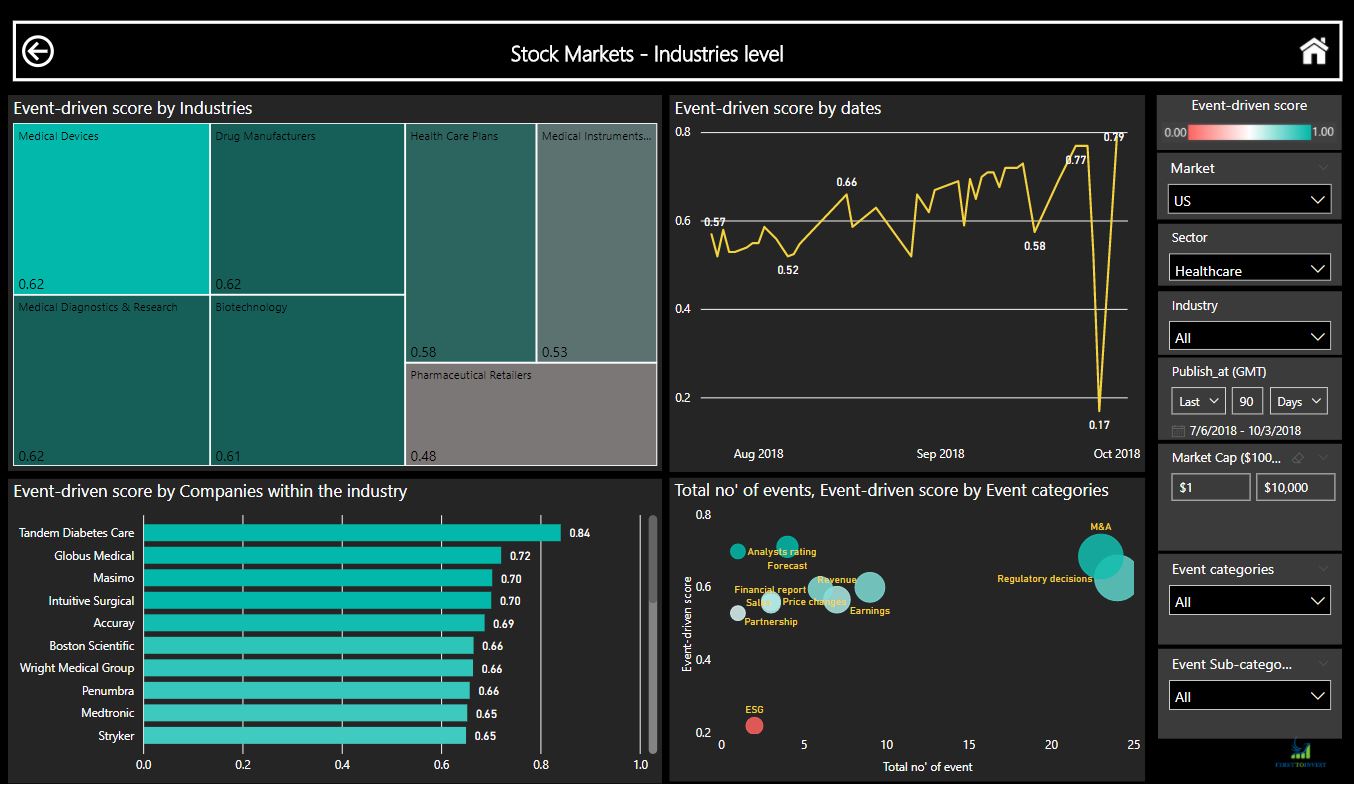

We used our system to analyze the Medical Device industry to see if the new tariff had impacted the industry scoring:

(The event-driven score is scaled between 0-1 where bellow 0.5 points to a bearish event-driven score based on events during the filtered period, above 0.5 points to bullish event-driven score) clicking here to trial our system

We can see that despite the panic in the Medical Device industry, the 90 days event-driven score for the industry is at the top in the sectoral level compared to other industries within the Healthcare sector. During the past 90 days, Medical Devices generated a 0.62 event-driven scoring followed by Medical Diagnostics & Research (0.62), Drug Manufacturers (0.619), Biotechnology (0.612), Health Care Plans (0.58), Medical Instruments & Supplies (0.53), and Pharmaceutical Retailers (0.48).

When analyzing the industry return, we see a positive return during the past 90 days (+11%) using iShares U.S. Medical Devices ETF returns.

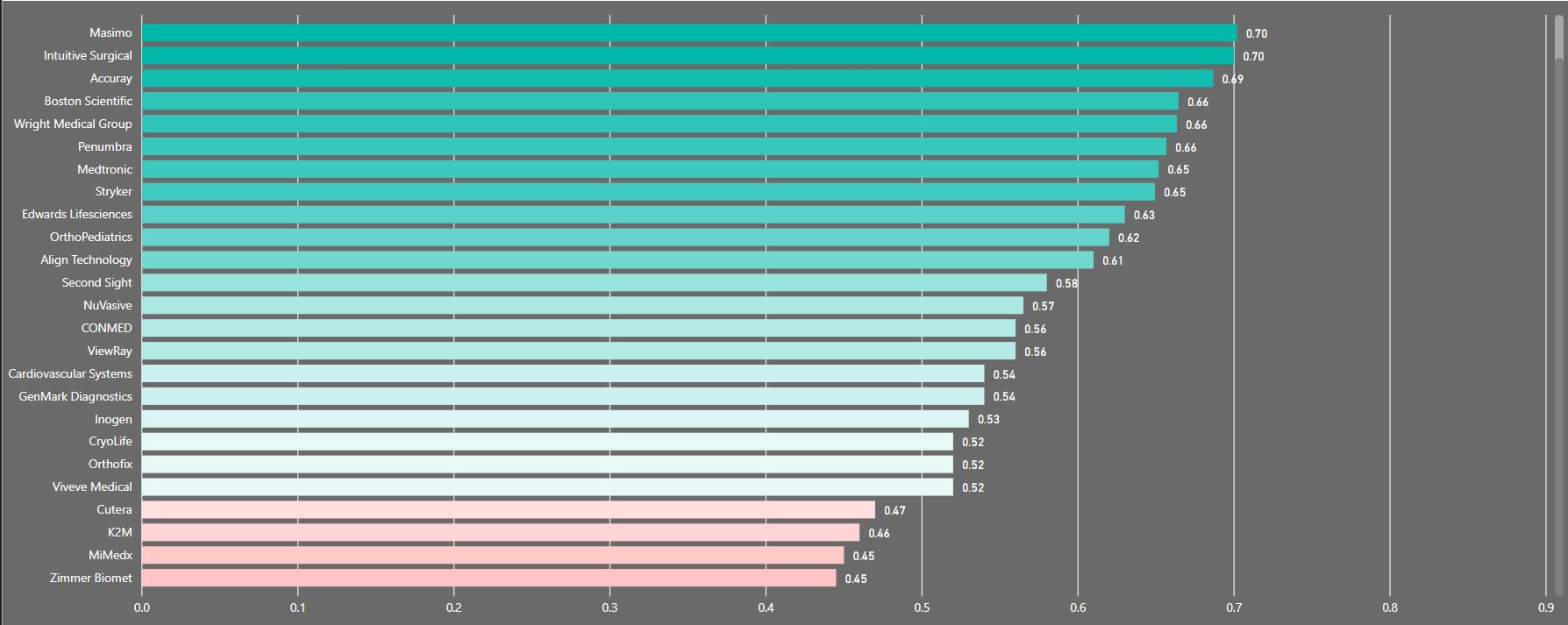

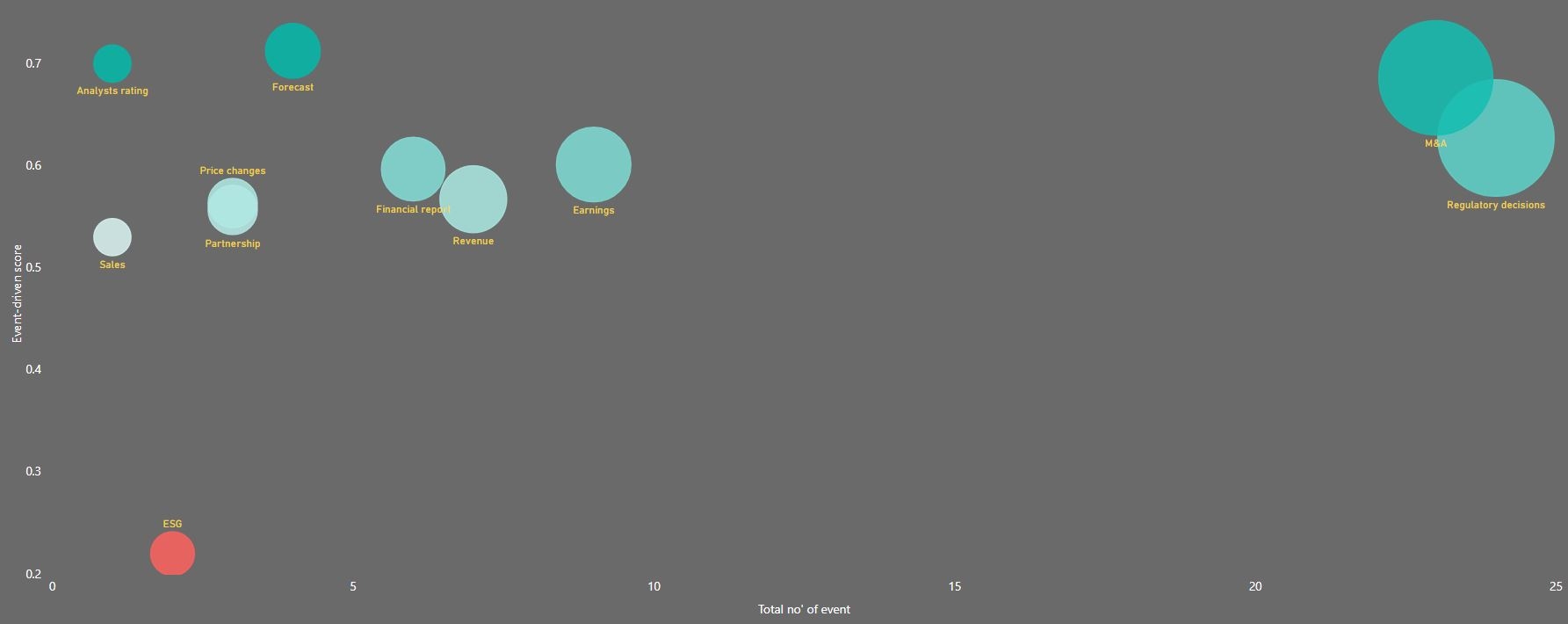

Looking at the companies within the Medical Device industry reveals higher scoring for most companies which indicate a bullish trend for the industry as a result of positively related events such as FDA approvals, earnings, M&A, partnerships, and much more.

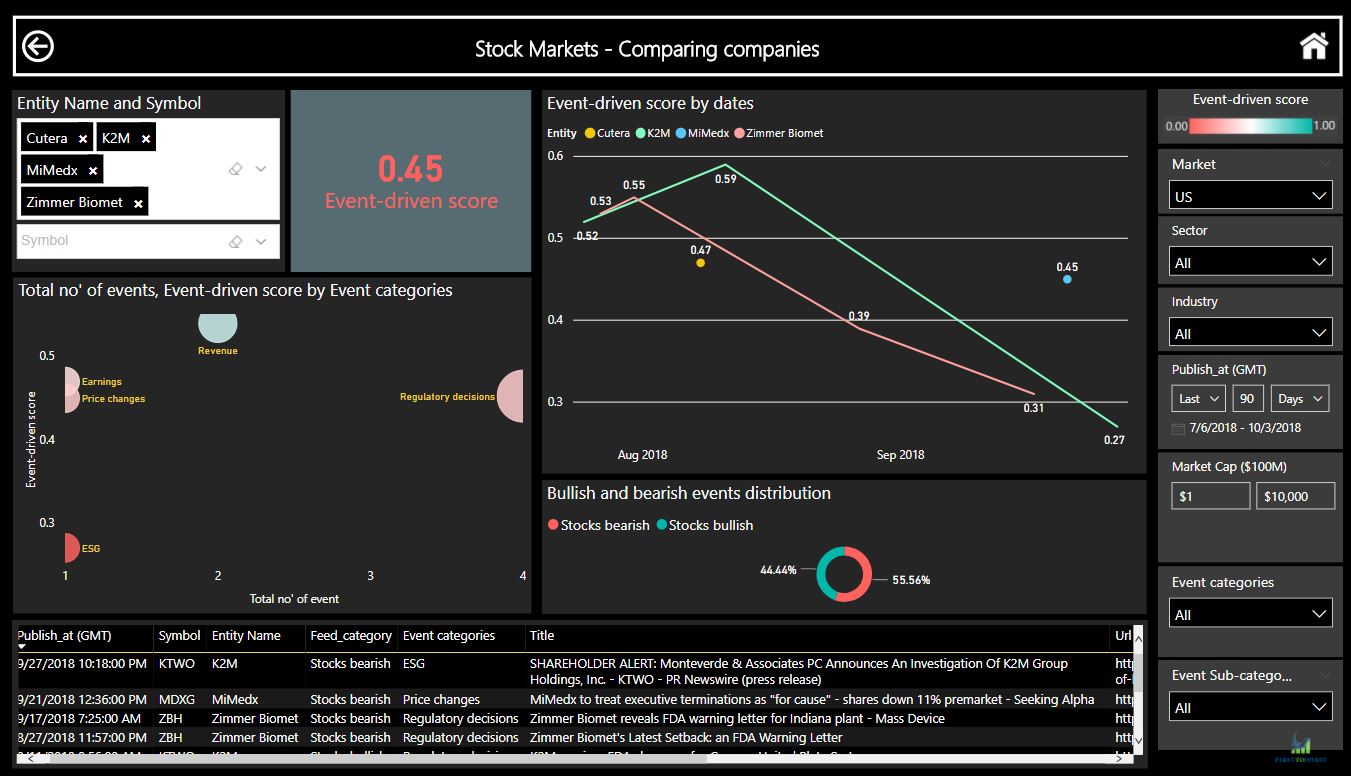

While most companies in the Medical Device industry are found above the 0.5 marks, there are some that are found below the mark, among them are Cutera, K2M, MiMedx, and Zimmer Biomet. These companies had more negative than positive related events such as Lawsuits, earnings miss, FDA approval decline, potential management change etc. Therefore, their scoring is found below the 0.5 marks which indicates a bearish territory.

From these data points, we can see a natural impact of the new tariff on the industry as it is the leader of the healthcare sector with the highest score of 0.62 and 11% return during the past 90 days. Having said that, only the future will reveal if the industry is riding on the bullish market trend or the companies within the industry are performing well and adjusted to the new business environment. From an event perspective, the Medical Device companies had more positive than negative related events with a strong outlook ahead.

In today’s rapidly changing environment it is essential to be able to track corporate events such as M&A, new deals, partnerships, ESG, regulatory decisions, management and stakeholders changes, expansions to new market or product categories, new products, price changes, new agreements, FDA decisions, financial reports related events, macroeconomics, and much more.

These events are found in traditional financial sources as well as in social media, however, it is critical to use reliable sources to avoid misleading events like in Tesla’s case. To extract, clean, and analyze the events, a hybrid model between human and machine should be conducted to get quality event detection and analysis. Finally, the event data should be streamed to the end user in the most compelling and easy to use methodology to avoid the data overload.

Tracking equities or other asset events can add an edge to new investment decisions, finding new opportunities, monitoring portfolios, mitigating risks, and acting as a complimentary analysis alongside to the traditional analysis.

Using big data and NLP technologies to capture alpha by collecting, structuring, and revealing events from news articles, press releases, and financial social media.

(Views and recommendations given in this section are for research purposes only. Please consult your financial adviser before taking any position in the stock/s or currencies mentioned.) Neither First to invest. nor any of its officers, employees, representatives, agents or independent contractors are, in such capacities, licensed financial advisors, registered investment advisers or registered broker-dealers. First to invest does not provide investment or financial advice or make investment recommendations. Nothing contained in this communication constitutes a solicitation, recommendation, promotion, endorsement or offer by First to invest of any particular security, transaction or investment.)

TAKE THE NEXT STEP