Using Corporate Events To Forecast Financial Outcomes

In today’s reporting session, it is essential to be able to track corporate events such as M&A, new deals, partnerships, ESG, regulatory decisions, management and stakeholder changes, expansions to new markets or product categories, new products, price changes, new agreements, FDA decisions, financial reports related events, macroeconomics, and much more. These events have prediction power on companies’ financial reports, specifically, the direction of the outcomes.

These events are helpful factors to forecast what will be the revenue and earnings direction as these events have an impact on the ongoing top and bottom line of each company. For example, today Lockheed Martin (LMT) presents a strong outcome. The company had a total of 17 events during the past quarter, including many new orders, partnerships, and buybacks. These events contribute to the company’s current financial results which had been seen in the company’s event-driven score before the financial report release.

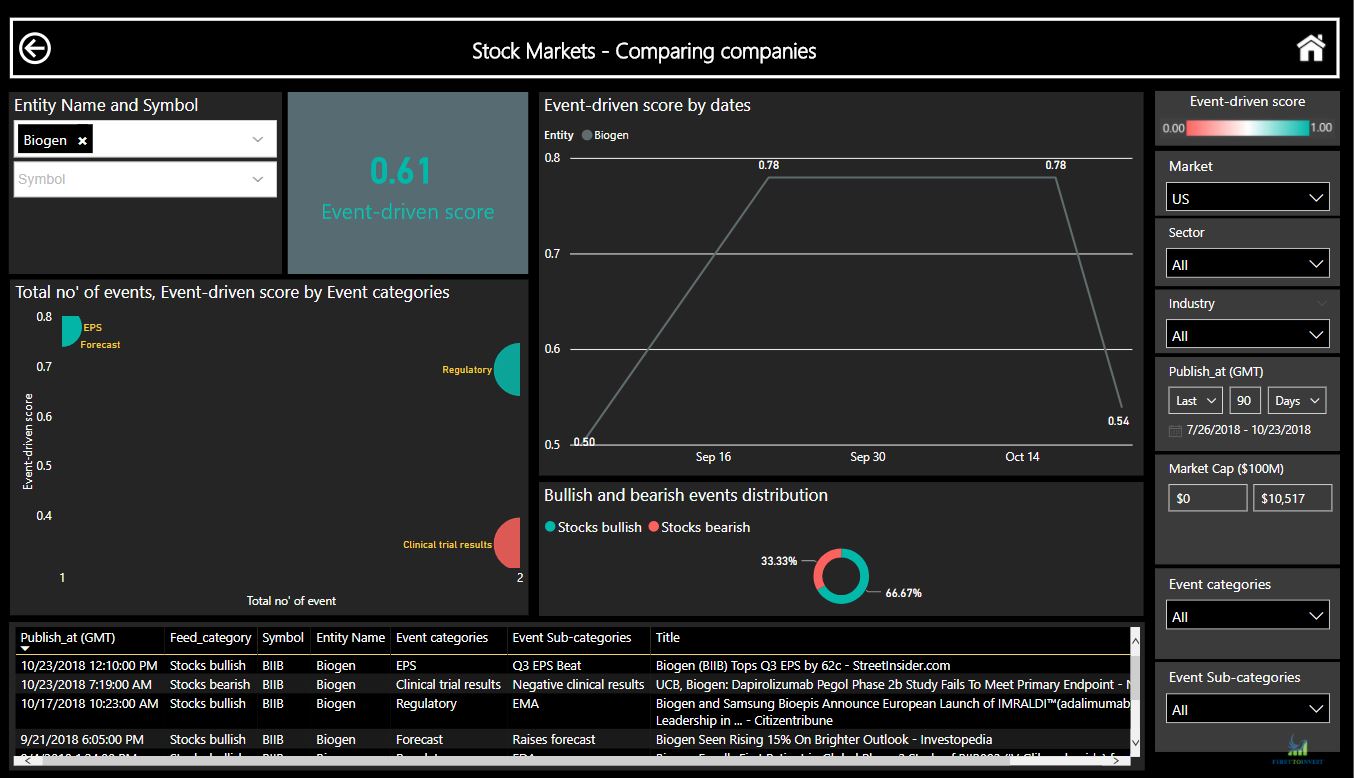

(The event-driven score is scaled between 0-1, where below 0.5 points to a bearish event-driven score based on events during the filtered period, and above 0.5 points to bullish event-driven score) click here for a trial of our system.

(The event-driven score is scaled between 0-1, where below 0.5 points to a bearish event-driven score based on events during the filtered period, and above 0.5 points to bullish event-driven score) click here for a trial of our system.

Another example is Biogen (BIIB), as the company’s EPS increase by 0.62c in today’s release. The company had a total of 6 events during the past quarter including multi approvals for new products, as well as guidance updates and two trials failed to meet the endpoints. Overall, the company’s event-driven score was 0.61 for a 90-day period, which indicates a bullish position

(The event-driven score is scaled between 0-1, where below 0.5 points to a bearish event-driven score based on events during the filtered period, and above 0.5 points to bullish event-driven score) click here for a trial of our system.

These are just 2 examples of many, as corporate events, like we describe above, have a tremendous impact on the companies’ ongoing operation, therefore, we can see the implication directly on the companies’ financial reports.

Tracking company’s or other asset’s events can add an edge to new investment decisions, such as finding new opportunities, monitoring portfolios, and mitigating risks; and this acts as a complimentary analysis alongside the fundamental or quant analysis.

Using big data and NLP technologies to capture alpha by collecting, structuring, and revealing events from news articles, press releases, and financial social media.

(Views and recommendations given in this section are for research purposes only. Please consult your financial adviser before taking any position in the stock/s or currencies mentioned.) Neither First to invest. nor any of its officers, employees, representatives, agents or independent contractors are, in such capacities, licensed financial advisors, registered investment advisers or registered broker-dealers. First to invest does not provide investment or financial advice or make investment recommendations. Nothing contained in this communication constitutes a solicitation, recommendation, promotion, endorsement or offer by First to invest of any particular security, transaction or investment.)

TAKE THE NEXT STEP