The Impact of Coronavirus on S&P 500 Companies Outlook

The spread of the coronavirus has reached a pandemic, spanning 112 countries and regions, the stock markets have officially plunged into correction territory—at the fastest rate ever recorded, suffering its worst losses since the 2008 financial crisis this week amid ongoing panic over the spreading coronavirus and its impact on the global economy.

Economists now say it is increasingly likely that virus-related financial fallout will spill over into the second quarter, cutting into GDP growth and potentially even dragging the American economy into recession. U.S. equity markets were shoved into their fastest correction in history as fears of the coronavirus spread in the US rattled investors and stoked recession fears.

“After 11 years, 13% annualized earnings growth and 16% annualized trough-to-peak appreciation, we believe the S&P 500 bull market will soon end,” wrote David Kostin, Goldman’s chief equity strategist.

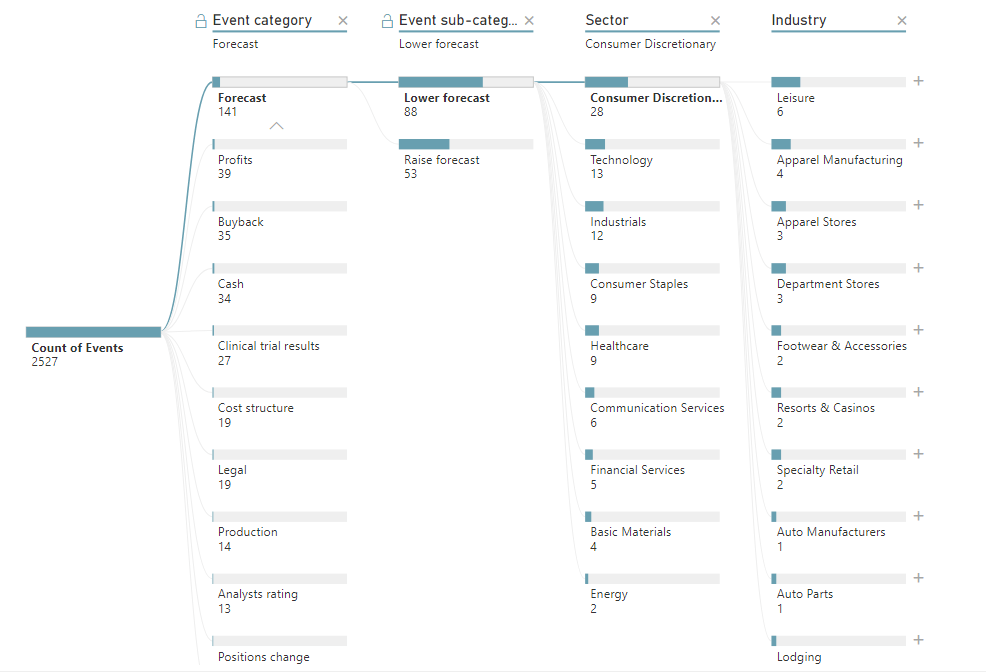

From Jan 2020 we found 144 companies from S&P 500 that provide new outlook based on the coronavirus impact using big data and NLP technology. 62 percent lowered their outlook while 38 percent sees better results during 2020.

The Impact of Coronavirus on S&P 500 Companies Outlook

Lower outlook list

Accenture

Advanced Micro Devices

Agilent Technologies

Albemarle

American Airlines

Amgen

Amphenol

Aptiv plc

Autodesk

Becton Dickinson

Booking

Boston Scientific

Broadcom

Capri Holdings

Carnival

Caterpillar

Centene

Cisco

Comcast

Conagra Brands

ConocoPhillips

CSX Corporation

Darden Restaurants

Delta Air Lines

Dollar Tree

DuPont

eBay

Ecolab

Electronic Arts

Estee Lauder

Expedia

Exxon Mobil

Facebook

Fiserv

FleetCor

Flowserve

Ford Motor

Gap Inc

Gilead Sciences

H&R Block

Hewlett Packard

Hilton Worldwide

Honeywell

Kellogg

Kohl’s

L Brands

Mastercard

MGM Resorts

Microsoft

Netflix

Nike

Nordstrom

Norwegian Cruise Line

NVIDIA

PayPal

PepsiCo

PerkinElmer

Ralph Lauren

Ross Stores

Royal Caribbean

Skyworks

Southwest Airlines

Take-Two Interactive Software

Tapestry

Target Corporation

Texas Instruments

Tractor Supply

Under Armour

United Airlines

United Parcel Service

VF Corporation

Visa

Xilinx

Increaced outlook list

Abbott

AbbVie

Adobe

Alphabet

Applied Materials

Broadcom

Campbell

Clorox

CMS Energy

Concho Resources

Constellation Brands

Coty Inc

CVS Health

D.R. Horton

DaVita

Edwards Lifesciences

Gap Inc

Garmin

General Electric

General Mills

Gilead Sciences

HCA Healthcare

HP Inc

Johnson & Johnson

Lam Research

Lamb Weston

Lockheed Martin

Medtronic

Merck

Microchip Technology

NVIDIA

Pfizer

Philip Morris

Procter & Gamble

Qorvo

QUALCOMM

Regeneron Pharmaceuticals

Salesforce

TE Connectivity

T-Mobile

Twitter

Union Pacific

Vertex Pharmaceuticals

Western Digital

We see that companies from the Consumer Discretionary and Consumer Staples sectors are lowered their outlook, the companies from Healthcare and entertainment are increasing their outlook as they expect the gain from the new coronavirus situation.

We are seeing an increasing demand for corporate financial and operational events feed, events such as suspend operations, lower outlook, profit warning, layoffs, management change, canceled product launch, service disruption, closing manufacturing plants and more are all over the news and social media.

FIRST TO INVEST is focusing on these events and many more i.e. 400 events categories and subcategories with global coverage.