Private equity alternative data Case Study – Snowflake

Snowflake provides a data warehouse as a service designed for the cloud, founded in 2012 and raised $928M to date. The company is headquartered in San Mateo, California, United States.

Snowflake offers corporate users to store and analyze data using cloud-based hardware and software. It runs on Amazon S3 since 2014, and on Microsoft Azure since 2018 It is being rolled out on Google Cloud Platform in 2019.

Snowflake’ main competitors are the big names in the industry, including Microsoft, Oracle, Amazon, Google, IBM and VMware to name a few.

From 2012 the company is growing constantly and in the past 3 years, the company enter into new markets and introduce new product capabilities. To support its growth, the company had to find strategic partners to enhance its core competences and go to markets strategy.

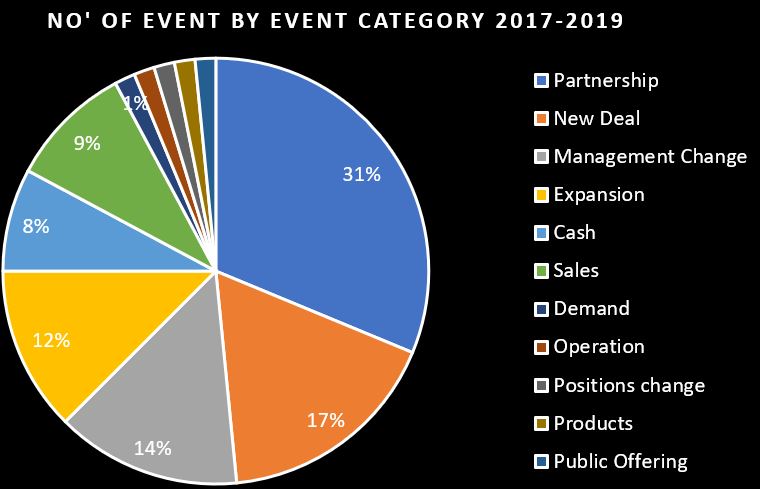

Between 2017-2019, Snowflake had 64 unique key-events, which support the company to its current position as a unicorn in the Software – Infrastructure industry. 92% of these events were positive including fundraising, sales growth, new deals, new partnerships, key management hiring, entering new markets and new product features. On the negative side, CEO replacement and increasing competition were classified as negative (8% from total events).

Key management change: During this period, the company hired a new CEO and CFO to prepare for potential IPO. On the operational side, Snowflake recruits new CCO and CSO.

In order to find these events, we use big data and NLP technology to search and extract key events that have a positive or negative effect on the company’s performance. Each event was scored based on our model which indicates the direction (positive or negative) and duration (long/short term).

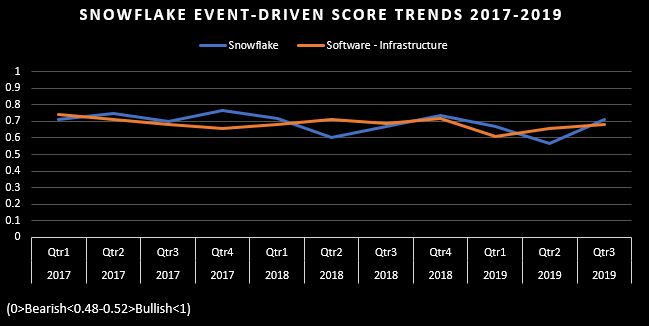

We factor these events into our model and generate an event-driven score on a quarterly basis for 2017-2019:

Snowflake’ event-driven score was steady on the positive side between 2017-2019 (above 0.52) which indicates more positive related events vs negative once (92% positive vs 8% negative).

Dipper look on the event category distribution shows that partnerships are a key factor in Snowflake success as well as rapid new deal growth. Between 2017-2019 the company partners with Microsoft, Databricks, Wipro, Taysols, Braze, Trinity Technology, TIBCO to name a few. These partnerships as well as new deal and fundraising, support the company expansion into unicorn status and well strong position in the industry.

Snowflake isn’t alone in this space. In fact, it faces competition from the biggest web companies and other startups. AWS Redshift is one of the more popular cloud data warehouse solutions available today. Google BigQuery is another great option for spiky workloads. Azure SQL Data Warehouse is the option from the Microsoft stable. Oracle has its own solution coming soon. Then there are other innovative startups in the space like Panoply, which also makes data warehousing easy and cloud-based. All this competition proves that data warehousing is big on the agenda of enterprises and cloud vendors alike.

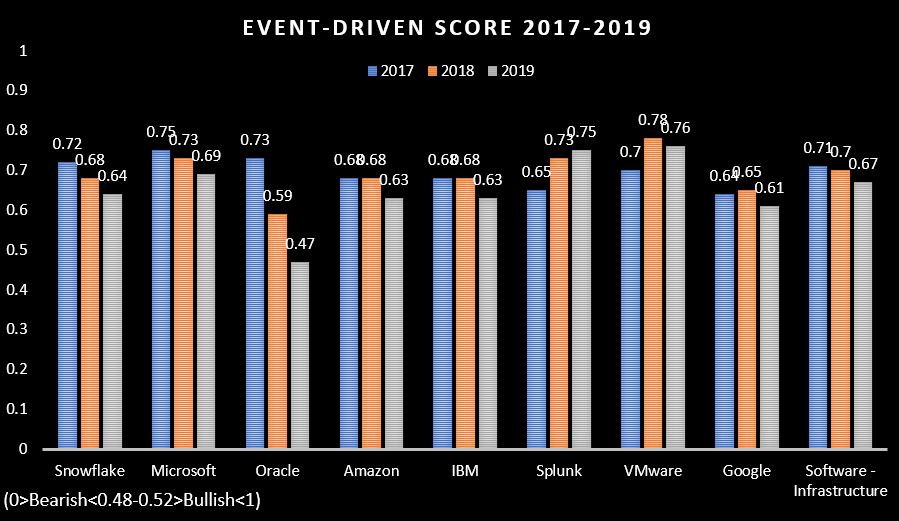

A comparison of Snowflake’ event-driven score to public traded peers shows a correlation with the trends of each competitor’ yearly event-driven score:

Snowflake’ yearly event-driven score trend was well aligned with the public traded peers between 2017-2019 i.e. above the 0.52 mark which indicates a bullish trend but with a slight downturn movement year over year.

The software-infrastructure industry event-driven score provides an indication of the industry trend. There is a slightly down movement from 2017-2019 which is being reflected in the peer’s comparison. Overall, the industry is well position on the bullish side trend between 2017-2019 with an average score of 0.69 on a yearly basis.

To conclude, Snowflake is well position against competitors, for rapid growth, supported by injection capital and more than tripled revenue YOY, a 257 percent increase in sales for 2018. As the software-infrastructure has good momentum and the demand is high for cloud infrastructure, the future for this company should be bright.

For more information on alternative data for private equity click here

Using big data and NLP technologies to capture alpha by collecting, structuring, and revealing events from news articles, press releases, and financial social media.

(Views and recommendations given in this section are for research purposes only. Please consult your financial adviser before taking any position in the stock/s or currencies mentioned.) Neither First to invest. nor any of its officers, employees, representatives, agents or independent contractors are, in such capacities, licensed financial advisors, registered investment advisers or registered broker-dealers. First to invest does not provide investment or financial advice or make investment recommendations. Nothing contained in this communication constitutes a solicitation, recommendation, promotion, endorsement or offer by First to invest of any particular security, transaction or investment.)

TAKE THE NEXT STEP