Alternative data for private equity funds

In today’s fast-paced M&A environment, deal making is increasingly a challenging task. Competition is only increasing as private equity (PE) firms, strategies, and other investors aggressively vie for the most attractive targets.

The biggest PE managers are investing in alternative data to spotlight opportunities in promising industry segments, to presage reasons to exit a portfolio investment and to improve the precision of their pricing models.

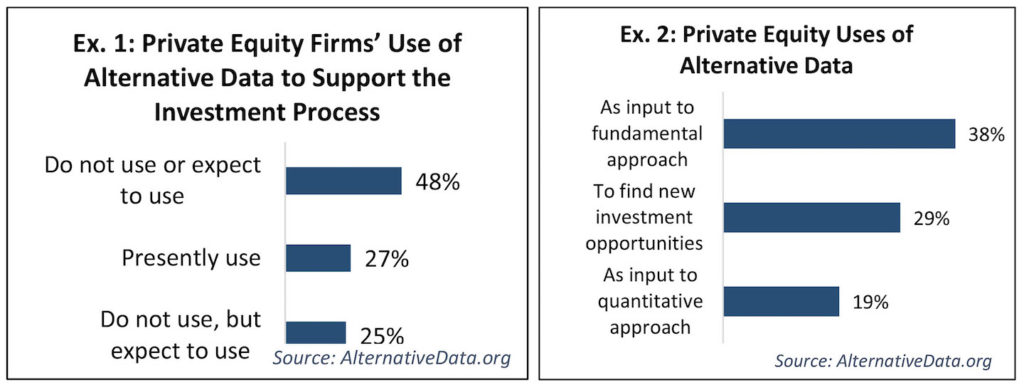

“The growing acceptance of alternative data is driving increased consideration of its use by Private Equity, as [27% of surveyed firms currently use it, and a further] 25% expect to use it in the near future. This is the move that will provide those adopters with an advantage to make better decisions.”

– Robert Iati, Private Equity’s Increasing Value for Alternative Data

Unlike public market traders who have an abundance of access to public company information, PE firms are looking for information about private companies, which can be much harder to come by. That makes the coverage alternative data providers can provide about private companies valuable.

How alternative data help private equity and venture capital funds?

Establishing a winning valuation requires a clear picture of the threats and opportunities of a target’s business model. To identifying growth opportunities pre deal, PE now leverage alternative data for helping answer key questions in the DD process such as:

— What is the target’s position among its competitors in the market?

— Are the sales, marketing, and customer success functions operating efficiently and effectively?

— What products, value propositions, and brands are under-leveraged in the market?

DD on the target company

- Use alternative data to identify fast-growing companies by monitoring events of a target company to make data-driven decisions: new product launch, fundraising, expansion to new markets, partnerships, joint venture, acquisition, management change, changes in the product pricing model, regulatory decisions, financial reports, and compare the data with public-traded peers

Once a deal has closed, PE firms are challenged to take steps to quickly increase asset value. Data science can play an important role in driving performance improvements within an acquired company or across a PE firm’s investment portfolio over time. PE firms can use alternative data to establish, measure, and monitor relevant, specific, and meaningful events over time.

Portfolio companies

- Track portfolio companies’ corporate events to monitor their business activities and make the right adjustment to their strategy

Finding new fast-growing companies

- Use alternative data to identify fast-growing companies by monitoring events of a specific industry both private and public companies, for example, monitoring the insurtech, regtech, payment industries

To sum, private equity and venture capital investors are increasingly turning to alternative data and external data to better sort out investment opportunities.

For a case study on tracking corporate events on a target company click here