Augmented Intelligence for Cyber Threat Response: A Human-AI Approach to Threat Intelligence

June 29, 2025

Augmented Intelligence for Cyber Threat Response: A Human-AI Approach to Threat Intelligence By First To InvestJune 2025 Executive Summary Cyber threats have grown increasingly sophisticated, coordinated, and global. Government agencies face mounting challenges in tracking, interpreting, and responding to these threats, particularly as attackers exploit systemic vulnerabilities and leverage transnational...

Read More

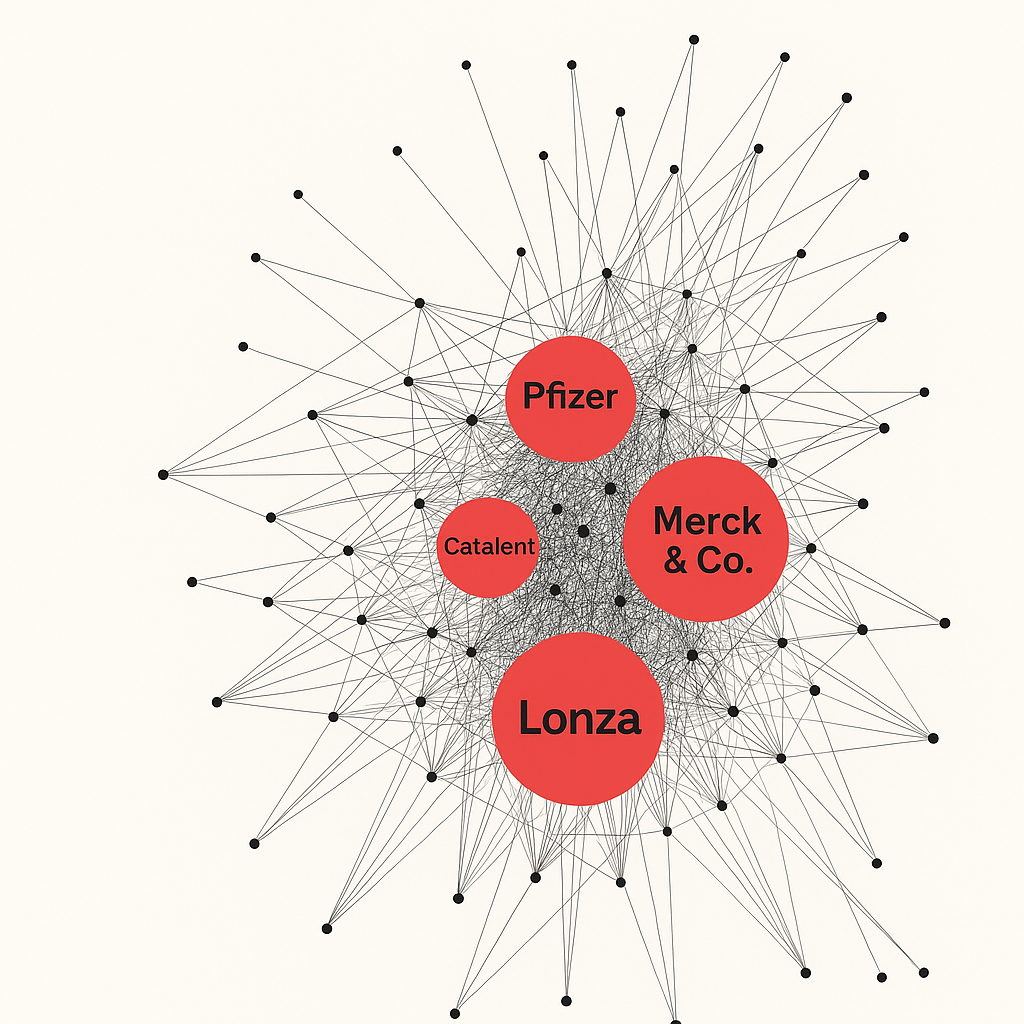

Mapping the Hidden Web – supply-chain dependency

June 22, 2025

Mapping the Hidden Web: How Network Analysis Is Transforming Pharmaceutical Supply Chain Resilience By First To InvestJune 2025 In the wake of global health disruptions—from pandemics to geopolitical tremors—the pharmaceutical supply chain has emerged as both a lifeline and a vulnerability. Behind the scenes, this complex system relies on tens...

Read More

How Predictive Analytics Enhances Government Cybersecurity

June 19, 2025

🧠 Detecting Tax Fraud Before It Happens: How Predictive Analytics Enhances Government Cybersecurity By First To InvestJune 2025 As government services become increasingly digital, fraud evolves with them. Today’s attackers don’t rely on brute force—they exploit verified identities, slip past traditional defenses, and operate in ways that look almost legitimate....

Read More

How Government Agencies Are Leveraging Open Source Intelligence (OSINT) to Transform Their Operations

May 24, 2025

How Government Agencies Are Leveraging Open Source Intelligence (OSINT) to Transform Their Operations open-source intelligence (OSINT) Open Source Intelligence (OSINT) has emerged as a game-changing capability for government agencies worldwide. By systematically collecting, analyzing, and acting upon publicly available information, agencies across different sectors are achieving their missions more effectively...

Read More

Geopolitical Shifts in India and Pakistan

May 7, 2025

India–Pakistan Conflict Tracker: Uncovering the Tensions Through Open-Source Media In May 2025, South Asia was once again thrust into the international spotlight, as India and Pakistan engaged in their most dangerous military escalation since the Pulwama-Balakot episode in 2019. This time, the trigger was not just a border skirmish —...

Read More

Geopolitical Shifts in the Arctic

April 17, 2025

Geopolitical Shifts in the Arctic: Strategic, Economic, and Military Dimensions Abstract The Arctic region has rapidly transformed into a focal point of geopolitical rivalry due to its immense untapped resources and strategic location. This research paper provides an in-depth analysis of the geopolitical, economic, and military developments in the Arctic...

Read More

The Guyana-Venezuela Territorial Dispute Over Essequibo

April 16, 2025

The Guyana-Venezuela Territorial Dispute Over Essequibo: Historical Roots, Economic Stakes, and Geopolitical Implications 1. Introduction The territorial dispute between Guyana and Venezuela over the Essequibo region is one of South America’s most enduring and complex conflicts, rooted in colonial history and shaped by contemporary geopolitical dynamics. Spanning approximately 159,500...

Read More

Anti-Erdoğan Protests in Turkey: An OSINT-Based Analysis (March 2025)

April 16, 2025

Anti-Erdoğan Protests in Turkey: An OSINT-Based Analysis (March 2025) Executive Summary Executive Summary: In March 2025, widespread protests erupted across Turkey in response to the arrest of Istanbul Mayor Ekrem İmamoğlu, a prominent opposition figure and perceived frontrunner in the 2028 presidential elections. This Open Source Intelligence (OSINT) report synthesizes...

Read More

Analytical Report: Key Takeaways from the 15th BRICS Summit 2023

August 23, 2023

Analytical Report: Key Takeaways from the 15th BRICS Summit 2023 Aug 23, 2023 Executive Summary The 15th BRICS Summit, held in Sandton, South Africa, featured a series of landmark discussions and revelations that point towards shifting geopolitical dynamics, economic aspirations, and ambitions for global influence among BRICS countries (Brazil, Russia,...

Read More

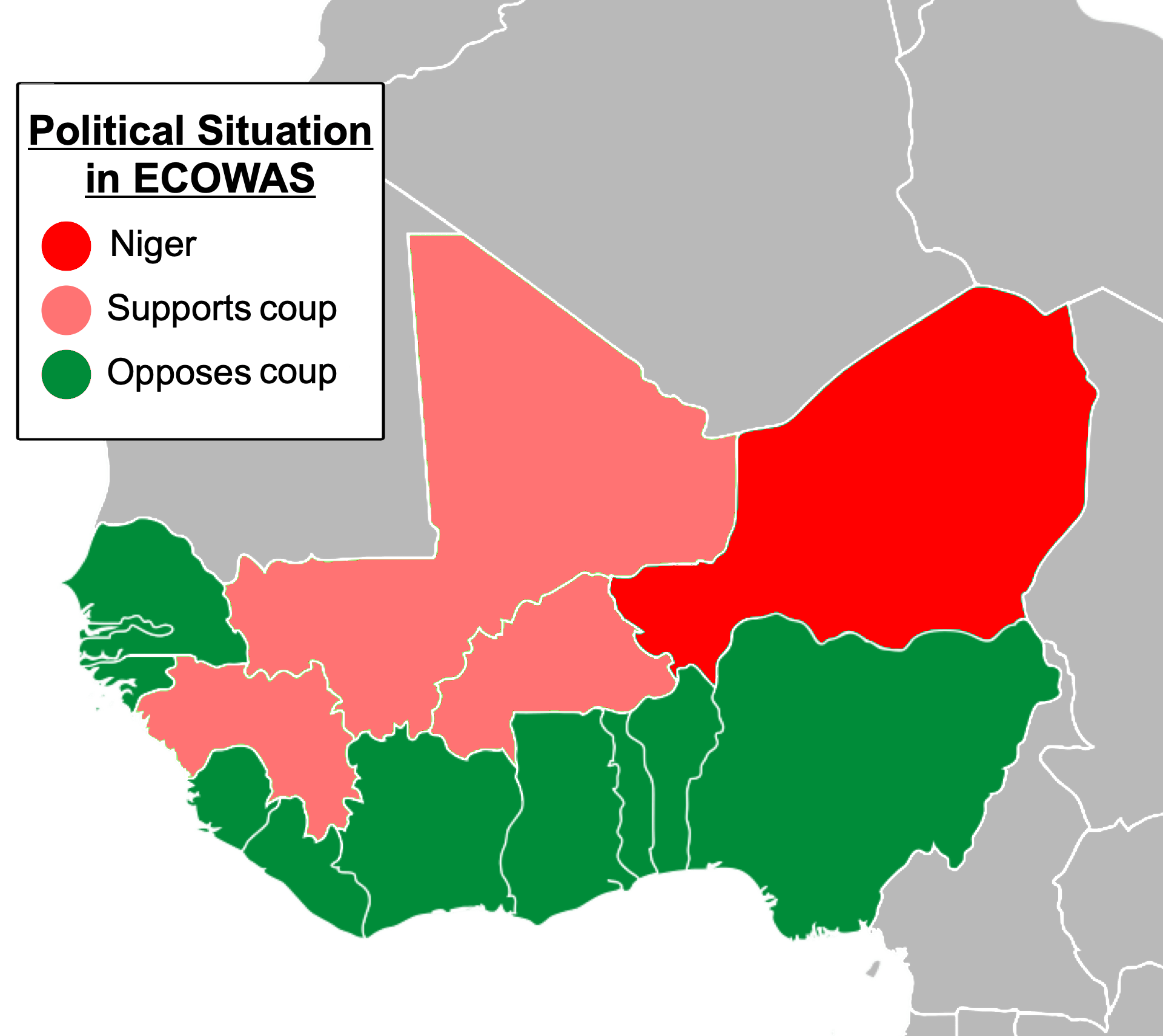

Coup in Niger

August 18, 2023

Intelligence Report: Coup in Niger 18 Aug 2023 Coup Details: The Nigerien military has staged a coup d'état, resulting in the detention of President Mohamed Bazoum. The individual leading this coup, a Nigerien general, has subsequently declared himself the new president of Niger. Reaction in West Africa: The broader West...

Read More

Cyber Threat Landscape Overview Aug 11 2023

August 11, 2023

Intelligence Analysis Report on Cybersecurity Threat Landscape 11 Aug 2023 Summary: The current global cybersecurity landscape reveals an increasing number of sophisticated cyberattacks and data breaches. These attacks have targeted educational institutions, financial organizations, healthcare providers, electoral commissions, and governmental bodies. There is an urgent need to prioritize cybersecurity measures...

Read More

The Rising Role of Rare Elements: China’s Stance and the World’s Response

August 6, 2023

The Rising Role of Rare Elements: China's Stance and the World's Response The current global environment is marked by significant shifts, both technological and geopolitical. Amidst these shifts, a certain segment of metals, specifically rare and precious ones like Gallium, Germanium, and Terahertz integrated photonic devices, have suddenly found themselves...

Read More

Cryptocurrency Under the Microscope: An Analyst’s Dive into Digital Assets

August 6, 2023

Cryptocurrency Under the Microscope: An Analyst's Dive into Digital Assets The tides of financial markets have always been intriguing, but none as much as the undercurrents of the cryptocurrency realm. The intersection of technology, economics, and human behavior in this sector offers a goldmine of insights. Today, we'll guide you...

Read More

Latest Startups Investment Analysis Report

August 4, 2023

Latest Startups Investment Analysis Report Introduction This report presents an analysis of recent investment and funding activities across various sectors, mainly focusing on technology, healthcare, finance, and startup ecosystems around the world. A surge in investment activities indicates a robust environment for technological innovation and growth. Here is a comprehensive...

Read More

Harnessing Alternative Data for Competitive Advantage

December 22, 2022

Harnessing Alternative Data for Competitive Advantage by Anil K. Gupta, Jon Norberg, Evan Schnidman, and Kai Wu We were accited to see our data sited in the article "A data tsunami is headed our way, with new types of data emerging at a staggering pace.1 Even simple devices such as EZPass...

Read More

Startups fundraising in May 2022

June 3, 2022

Startups fundraising in May 2022 Right now, startups are facing a contraction in valuation — not revenue, which was the case in the early COVID days. Public-market comps are down 60% or more in some sectors, and they tend to be the leading indicator of how VCs are similarly going...

Read More

Top unicorn investors

April 13, 2022

Top unicorn investors “Unicorn” is a term used in the venture capital industry to describe a privately held startup company with a value of over $1 billion. One of the best indicators that a company is on track to becoming a unicorn is its investment history. Soon-to-be or “baby unicorns”...

Read More

Startups’ fundraising and secondary deals database

March 1, 2022

Startups' fundraising and secondary deals database The easiest way to discover promising companies, source deals, and leads Whether you are looking for companies to invest in, collaborate with, or offer services to, you are in the right place. Using big data and NLP technologies to find startups' fundraising and secondary...

Read More

FIRST TO INVEST and transACT Technology Solutions

February 25, 2022

FIRST TO INVEST and transACT Technology Solutions 📢CUSTOMER SUCCESS STORY ALERT!📢 ⭐The Customer – FIRST TO INVEST First To Invest provides data systems with deep analytics that drive the decisions of global organizations, including world-leading quants, fundamental hedge funds, assets managers, private equity, and corporates. ❓The Challenge: First to Invest sought...

Read More

Private equity and Venture capital – use cases

February 6, 2022

Private equity and Venture capital - use cases (Views and recommendations given in this section are for research purposes only. Please consult your financial adviser before taking any position in the stock/s or currencies mentioned.) Neither First to invest. nor any of its officers, employees, representatives, agents or independent contractors...

Read More