Industry overview using alternative data: Oil & Gas Integrated

An integrated oil and gas company is a business entity that engages in the exploration, production, refinement, and distribution of oil and gas. Given the high entry costs relating to many oil and gas industry operations, many of the world’s largest oil and gas companies, like Chevron Corporation and Exxon Mobile, are integrated.

Typically, integrated companies divide their various operations into categories: upstream, which includes all exploration and production endeavors, and downstream, which is confined to refinement and marketing activities. (Investopedia)

This industry is unique in that geopolitics play a big role. Security concerns in several key oil-producing nations have made it difficult to maximize production. Other countries have taken a go-slow approach to exploration. These factors are a drag on drilling potential, but they support long-term oil prices. Cost inflation can be a problem during boom times. The industry tries to keep expenses under control by ordering bundled packages from oilfield service providers to gain volume discounts.

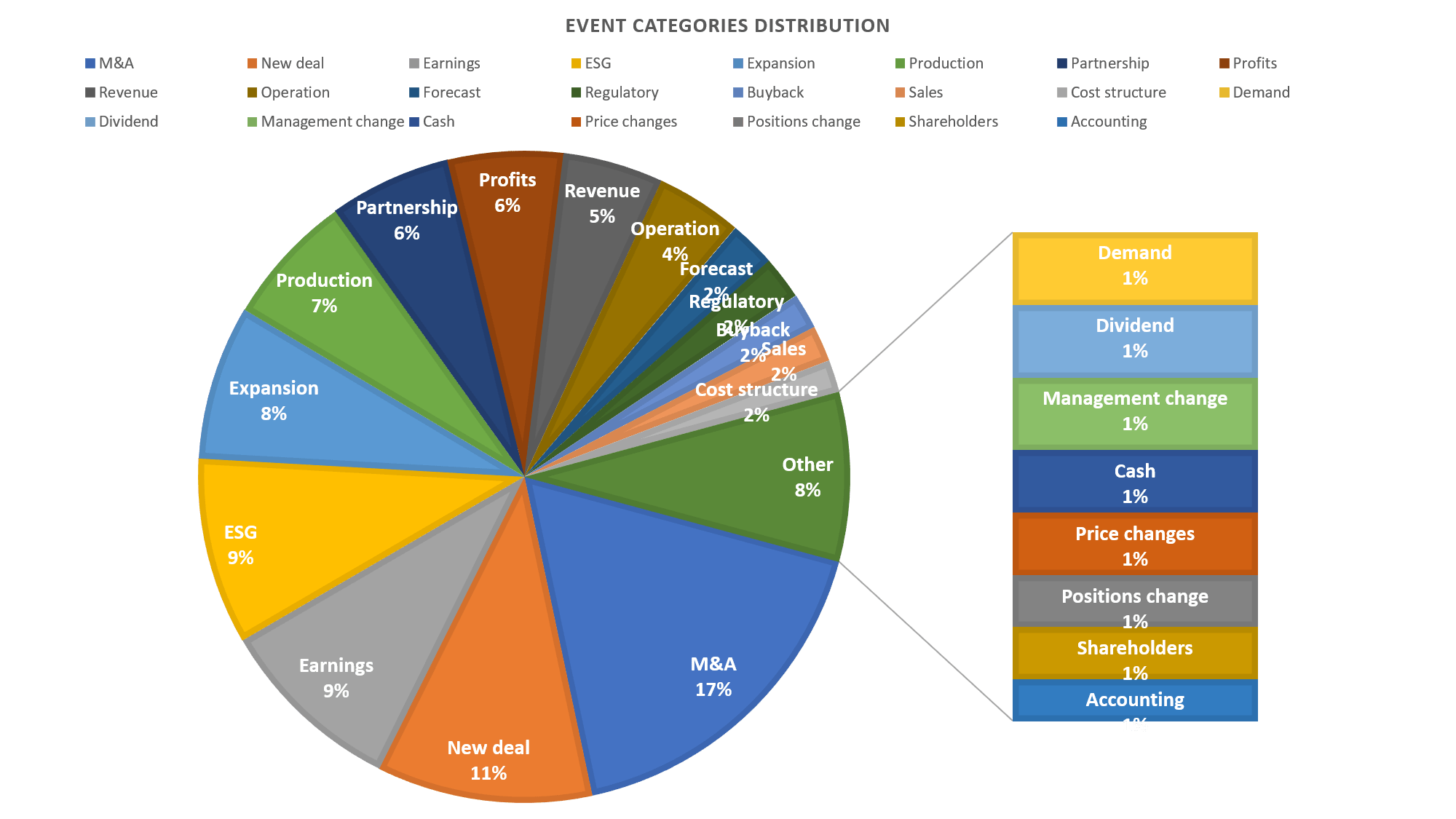

The key attributes to the industry growth are M&A and partnership activities which are found to be the path for sustainability and operational efficiency and more recently, ESG has made its impact on industry performance and we are witnessing a major shift to more clean and sustainable energy sources.

In order to map the global Oil & Gas Integrated industry, key events of companies within the industry need to be extracted and tagged to provide broader views on the future of the industry.

Why using event extraction?

90% of financial data is in text form – news articles, research documents and financial statements associated with specific companies. Thousands of news articles and financial disclosures are published each day and to manually read millions of lines of text is impossible and does not allow for the efficient extraction of information focused on key events.

We used alternative data (Using Big data and NLP technologies to collect, structure, and reveal events from news articles, press releases, and financial social media) to analyze the Oil and Gas integrated industry key events during 2019.

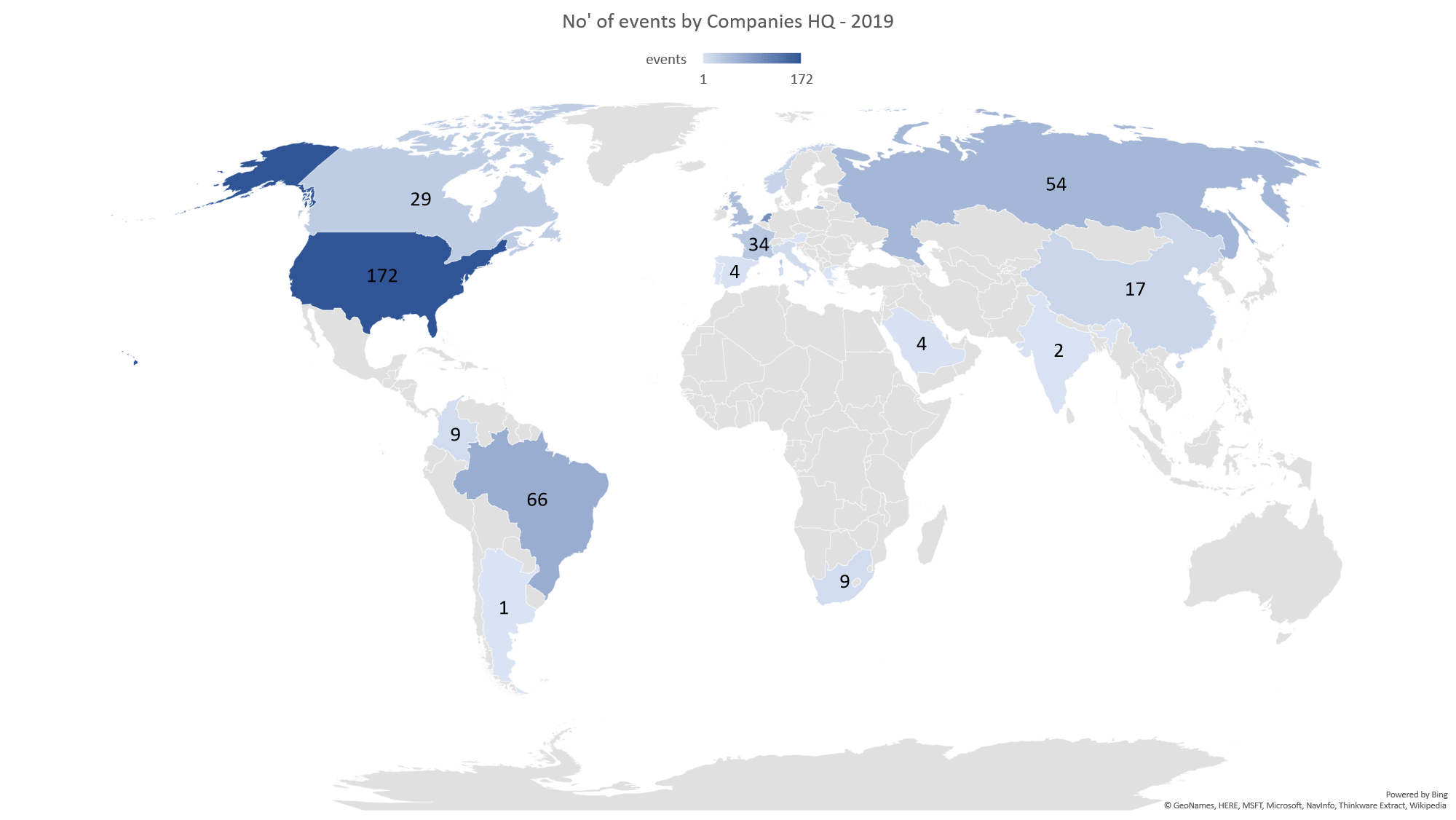

The industry as a whole had 582 unique events globally during 2019, a unique event describes as an individual event that can be republished many times over news publication and social media.

Event categories analysis

2019 was a very active on the M&A in the industry with 98 unique events including;

- Exxon Mobil selling Norwegian North Sea assets for $4.5B,

- Petrobras starts sale process for refining and logistics assets

- Petrobras sells 90% stake in gas pipeline for $8.6 billion

- Total enters $8.8 billion deal with Occidental for Anadarko’s Africa assets

- Total reaches deal to buy Toshiba’s U.S. LNG business

- Equinor to Pay $965MM for Stake in Shell’s GOM Oilfield

- Aramco to buy Shell’s 50 percent stake in Saudi refining JV for $631 million

Key new deals during 2019

- Gas giant Gazprom, Ukraine finalise deals to ship Russian gas to Europe

- Exxon acquires 1.7 mln exploration acreage offshore

- Petrobras to lease LNG operations in Bahia state

- SunPower Building New 35-Megawatt DC Solar Project to Supply Renewable Energy to Chevron’s Lost Hills Oil Field

- Exxon Mobil, Shell among groups to build five Pakistan LNG terminalsv

- Tokyo Gas, Shell sign LNG supply deal based on coal-indexation

- Total signs 10-year gas supply deal with China

ESG events made some interesting headline during 2019 including;

- Exxon Well Blast Caused Huge Methane Leak in Ohio

- Shell says oil spill contained at Puget Sound

- BP and Environmental Defense Fund Collaborate to Reduce Methane Emissions

- Shell facing multiple charges over corruption, emissions, and an explosion

- Workers at Shell’s Dutch plants plan strike from April 8

- Chevron CEO plans major cost-cutting overhaul of production teams

- Husky Energy confirms 370 job cuts as it trims 2020-21 spending by $500 million

alternative data events of oil and gas integrate industry – events distribution

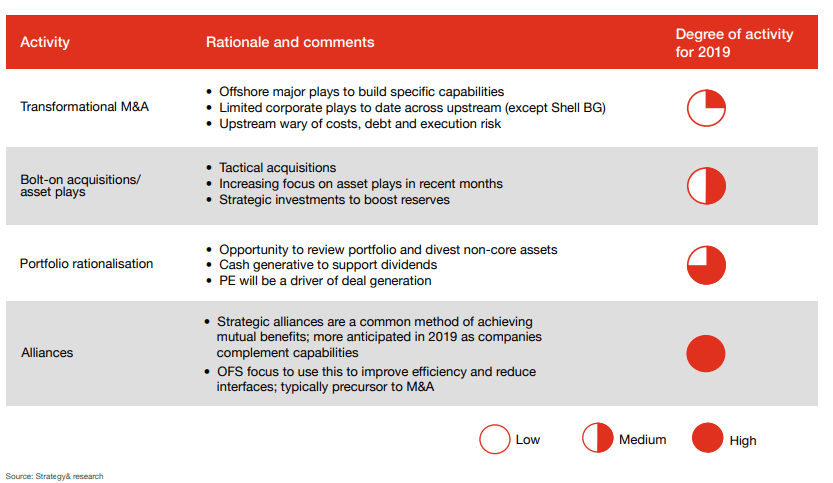

These events representation has corresponded to PwC research on Oil and Gas corporate activities.

Looking ahead to 2020 trends

Environment

Oil and gas companies are facing a critical challenge as the world increasingly shifts towards clean energy transitions. Fossil fuels drive the companies’ near-term returns, but failure to address growing calls to reduce greenhouse gas emissions could threaten their long-term social acceptability and profitability (International Energy Agency)

According to a survey by an adviser to the industry (Nina Chestney), more than 70% of oil and gas executives expect to maintain or increase investment in low-carbon energy this year. 71% expect to increase or maintain investment in renewable energy, decarbonizing oil and gas production and new low-carbon technologies, compared with 54% a year ago.

Trade War

The oil industry is capital intensive, and some of that capital equipment comes from China. Chinese steel, for example, is considerably cheaper than U.S. steel. If a pipeline company, for example, is forced to buy more expensive steel, it will impact capital budgets and result in fewer projects. Another factor to consider is that China was becoming an increasingly important market for U.S. oil exports. Last summer U.S. exports to China had reached half a million barrels a day, but because of the trade war, China stopped buying U.S. crude. They turned instead to Iran for their crude oil needs (Forbes).

Saudi Aramco

Aramco’s attractive dividend payout could draw investors away from other oil competitors with lower yields. Aramco management has committed to a minimum dividend of $75 billion a year, from 2020 to 2024 Exxon Mobil (XOM) and Chevron (CVX) have among the lowest yields among western oil majors, but they also have a better growth outlook with the large shale oil deposits in the U.S. Emerging market oil majors with lower yields, such as PetroChina Company (PTR) and Petróleo Brasileiro (PBR), might turn out to be most at risk, says Beveridge.

To conclude, A combination of commodity price fluctuations, ambiguity about the future of fossil fuels and increasingly contentious trade negotiations around the world are upending traditional supply and demand fundamentals, bringing a set of new challenges. It could be said that this year, oil and gas executives are essentially trying to set a growth course for their companies on shifting sands.