Alternative data for private equity funds

How alternative data help private equity and venture capital funds?

Establishing a winning valuation requires a clear picture of the threats and opportunities of a target’s business model. To identifying growth opportunities pre deal, PE now leverages alternative data for helping answer key questions in the DD process such as:

— What is the target’s position among its competitors in the market?

— Are the sales, marketing, and customer success functions operating efficiently and effectively?

— What products, value propositions, and brands are under-leveraged in the market?

DD on target company

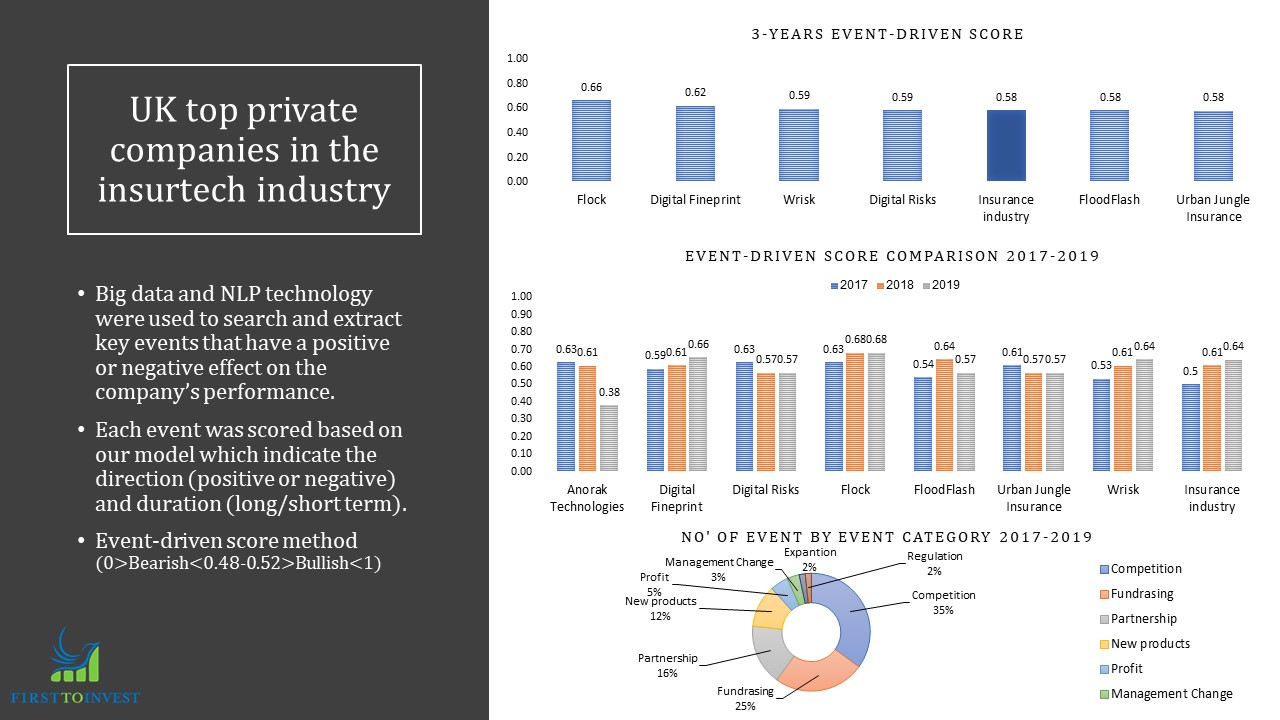

- Use alternative data to identify fast-growing companies by monitoring events of a target company to make data-driven decisions: new product launch, fundraising, expansion to new markets, partnerships, joint venture, acquisition, management change, changes in the product pricing model, regulatory decisions, financial reports, and compare the data with public-traded peers

Once a deal has closed, PE firms are challenged to take steps to quickly increase asset value. Data science can play an important role in driving performance improvements within an acquired company or across a PE firm’s investment portfolio over time. PE firms can use alternative data to establish, measure, and monitor relevant, specific, and meaningful events over time.

Portfolio companies

- Track portfolio companies’ corporate events to monitor their business activities and make the right adjustment to their strategy

Finding new fast-growing companies

- Use alternative data to identify fast-growing companies by monitoring events of a specific industry both private and public companies for example, monitoring the insurtech, regtech, payment industries

To sum, private equity and venture capital investors are increasingly turning to alternative data and external data to better sort out investment opportunities.

For a case study on tracking corporate events on a target company click here