Alternative data: Uber not a surprise…

Uber Technologies Inc (UBER) on Monday posted a wider third-quarter loss as costs at the ride-hailing company soared, sending shares down 6.7% in after-hours trading.

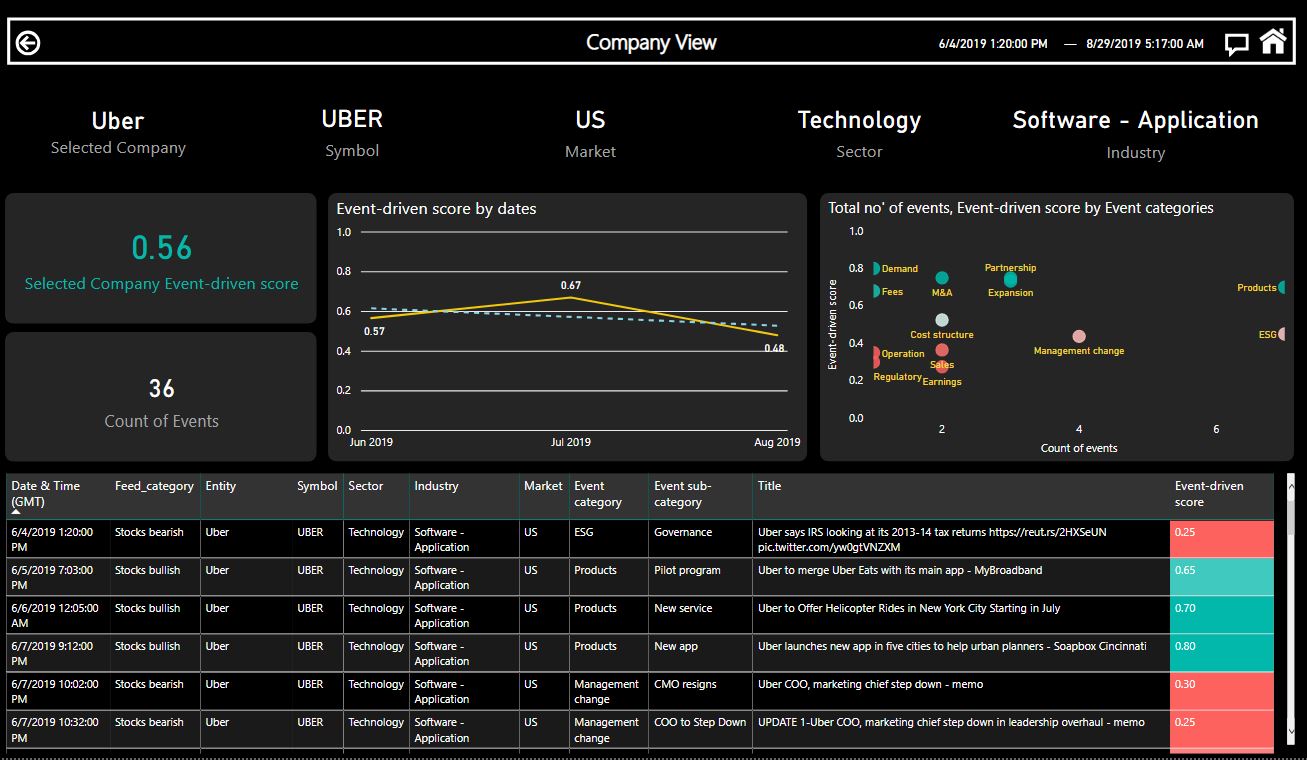

Based on Uber’s 3Q event analysis we can see that Uber’s event-driven score is in a downtrend and cross the 0.5 marks to the bearish territory.

In order to find these events, we use big data and NLP technology to search and extract key events that have a positive or negative effect on the company’s performance. Each event was scored based on our model which indicates the direction (positive or negative) and duration (long/short term).

(0>Bearish<0.48-0.52>Bullish<1)

Uber’s costs jumped about 33% to $4.92 billion in the reported quarter. Gross bookings, which include ride-hailing, mobility, food delivery and freight payments before costs and other expenses, rose 29.4% from a year earlier to $16.47 billion.

Using big data and NLP technologies to capture alpha by collecting, structuring, and revealing events from news articles, press releases, and financial social media.

(Views and recommendations given in this section are for research purposes only. Please consult your financial adviser before taking any position in the stock/s or currencies mentioned.) Neither First to invest. nor any of its officers, employees, representatives, agents or independent contractors are, in such capacities, licensed financial advisors, registered investment advisers or registered broker-dealers. First to invest does not provide investment or financial advice or make investment recommendations. Nothing contained in this communication constitutes a solicitation, recommendation, promotion, endorsement or offer by First to invest of any particular security, transaction or investment.)

TAKE THE NEXT STEP