Mapping the Hidden Web: How Network Analysis Is Transforming Pharmaceutical Supply Chain Resilience

By First To Invest

June 2025

In the wake of global health disruptions—from pandemics to geopolitical tremors—the pharmaceutical supply chain has emerged as both a lifeline and a vulnerability. Behind the scenes, this complex system relies on tens of thousands of interactions: raw material suppliers in India, manufacturers in Europe, logistics hubs in the U.S., and distribution channels that span the globe. But how do we make sense of such intricate interdependencies?

The answer, increasingly, lies in network science.

Rethinking the Chain: From Linearity to Networks

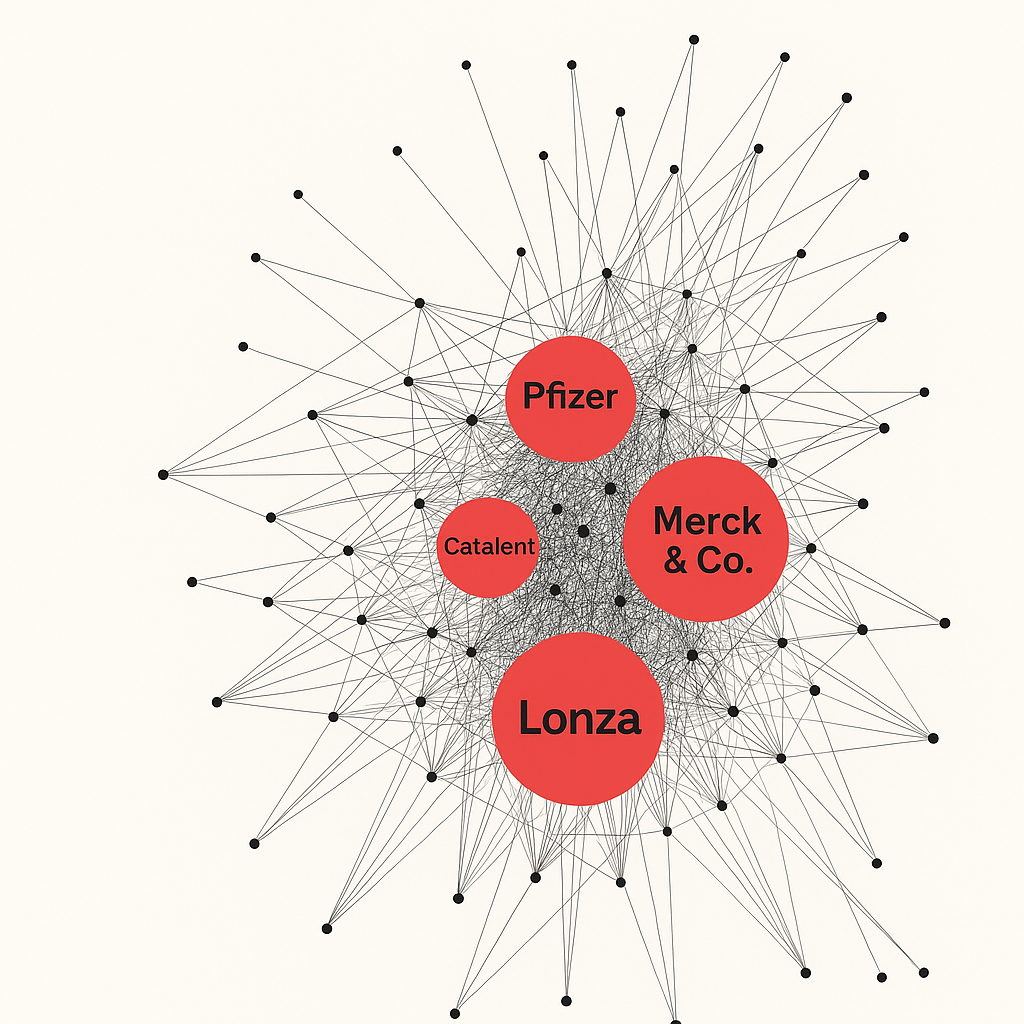

Traditional supply chain thinking often views product flow as linear: supplier → manufacturer → distributor → provider. In reality, the pharmaceutical world is anything but linear. Companies can simultaneously act as both suppliers and buyers, and products pass through a dense web of relationships. A more accurate and actionable perspective comes from visualizing the supply chain as a network, with companies as nodes and transactions as edges.

A recent study applied this model to over 16,000 entities and nearly 11,000 supplier-buyer relationships. The result? A directed graph that revealed both the strengths and weaknesses of the global pharmaceutical system.

Key Insights from the Network Map

1. A Few Companies Are Critically Central

Pharmaceutical giants like Pfizer, Merck & Co., and outsourcing specialists such as Catalent and Lonza serve as hubs with extremely high connectivity. They’re not just central because of size—they’re central because so many others depend on them. Disruption at one of these hubs could ripple through hundreds of downstream partners.

2. Many Companies Are Both Suppliers and Buyers

More than 1,300 companies operate in dual roles, creating complex feedback loops and bottlenecks. These “bridges” often hold high betweenness centrality, meaning they sit on the shortest paths between other entities. Their failure could fragment the entire network.

3. Logistics Add a Layer of Fragility

Not all supply chain vulnerabilities are corporate. The network is deeply reliant on air freight for global movement and cold chain logistics for sensitive products like vaccines and biologics. These modes are fast but fragile—prone to disruption from regulatory delays, energy instability, or global conflicts.

4. Geography Concentrates Risk

While the supply chain is global, operations are geographically clustered. The U.S., China, Japan, India, and major European countries dominate in terms of facility count. Domestic flows are dense, but cross-border routes—especially India→USA and China→USA—represent critical dependencies.

5. Some Products Are Resilient—Others Are Not

Generic categories like “Pharmaceuticals” or “APIs” benefit from multiple suppliers and diverse routes. In contrast, proprietary or narrowly manufactured products often rely on just a handful of upstream providers, posing risks of shortages if any one link fails.

From Mapping to Mitigation: What Can Be Done?

Understanding is only the first step. Armed with network insights, stakeholders can take proactive measures:

-

Diversify supplier networks to avoid reliance on single points of failure.

-

Build redundancy by enabling multiple logistics pathways for critical products.

-

Encourage modularity, allowing regional sub-networks to function semi-independently during crises.

-

Promote localized production and strategic stockpiling of essential drugs and raw materials.

-

Enhance data transparency to allow real-time visualization and risk assessment.

Governments and pharmaceutical companies alike can use this network view to make smarter investments, prepare for potential shocks, and design systems that bend—but don’t break—under pressure.

Final Thoughts

Network analysis doesn’t just add another layer of complexity—it brings clarity. By moving beyond spreadsheets and supply chain diagrams to understand who depends on whom, and how deeply, the pharmaceutical industry can better protect one of the world’s most precious commodities: the uninterrupted flow of life-saving medicine.