Alternative data: ESG Case Study

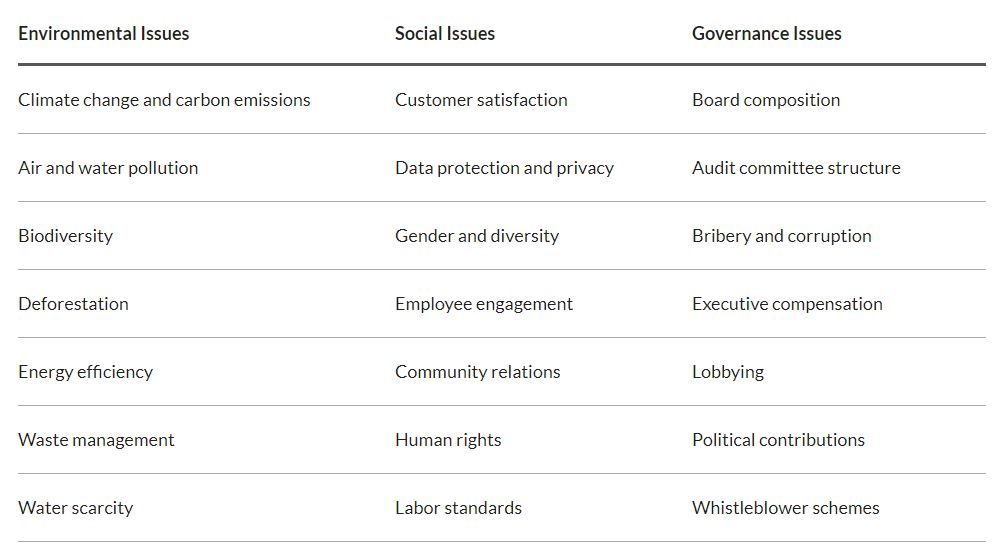

Environmental, social and corporate governance (ESG) refers to the three central factors in measuring the sustainability and ethical impact of an investment in a company or business. These criteria help to better determine the future financial performance of companies (Wikipedia).

ESG is growing in significance amongst institutional investors. Today, ethical considerations and alignment with values are common motivations of many ESG investors but the field is rapidly growing and evolving, as many investors look to incorporate ESG factors into the investment process alongside traditional financial analysis.

Despite the growth in ESG disclosures, investors still often lack sufficient indicators of financially relevant ESG risks. Alternative data sources can help fill the disclosure gap by helping minimize reliance on voluntary disclosure to deliver key insights.

The fact that the data is publicly available does not automatically mean it is also easily available. In order to find the ESG events, we use big data and NLP technology to extract key events that are categories as ESG and have a positive or negative effect on the company’s performance from multiple sources.

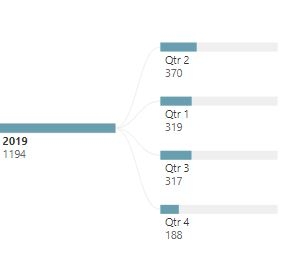

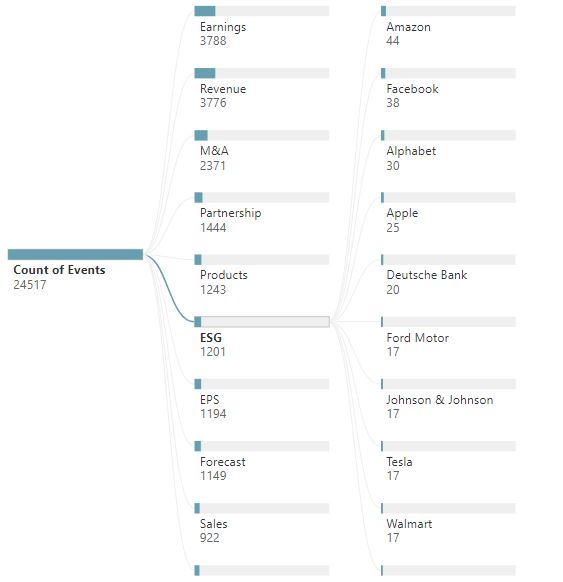

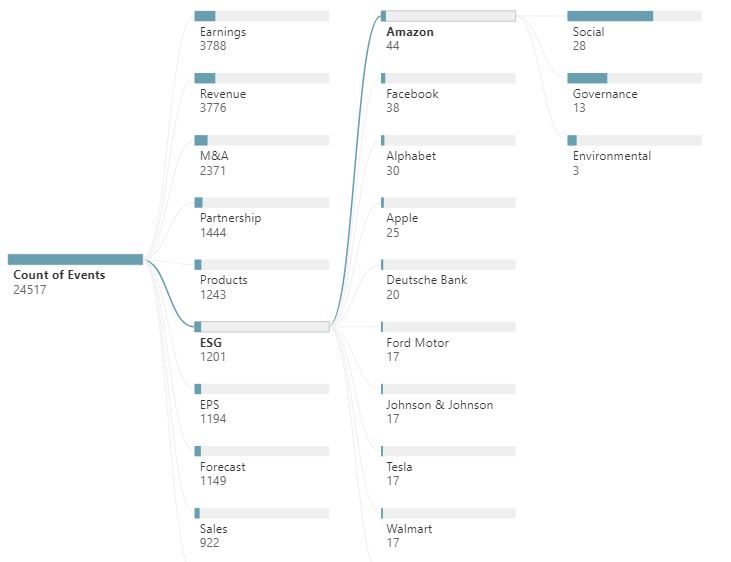

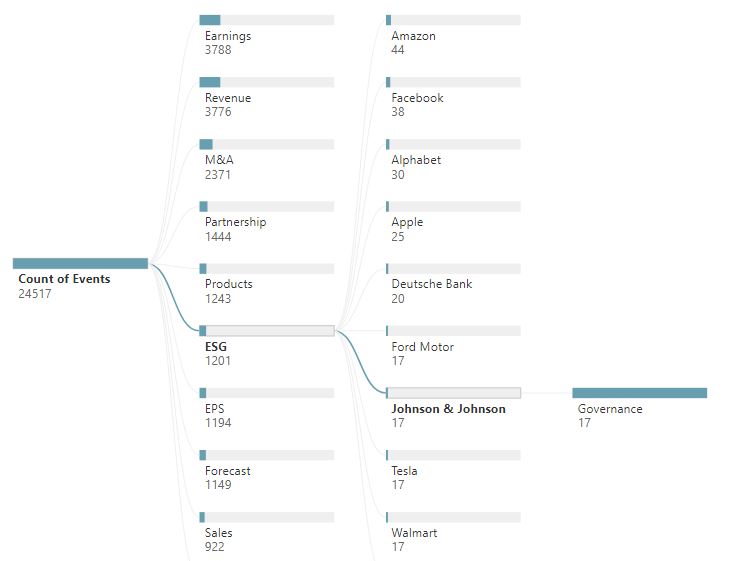

From Jan 2019 to date (11.26.19) we found 1194 individual events that are under the ESG category in the US market. The distribution between the categories is as follow: Environmental (6%) Social (44%) and Governance (50%). We don’t find any seasonality between quarters:

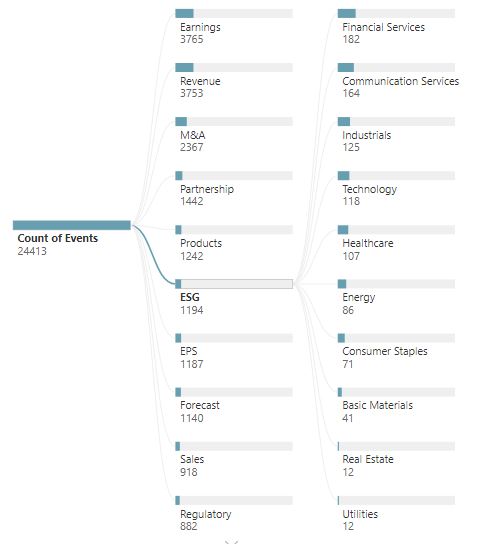

On a sectoral level, we the data below show how the ESG events were distributed between sectors in the US market during this period

The financial services sector is leading by the number of events with 15% of all events which can be explained by the changing in governance practice, board structure, external audit committees and more correlated compensation for top management and board members on the positive side. While scandals, bribery, corruption, lawsuits, layoffs, shareholders alerts were found on the negative side.

The communication services sector is the second biggest ESG catalyst with 10% of all events which can be explained by data breach events, new hiring, and layoffs, lawsuits etc…

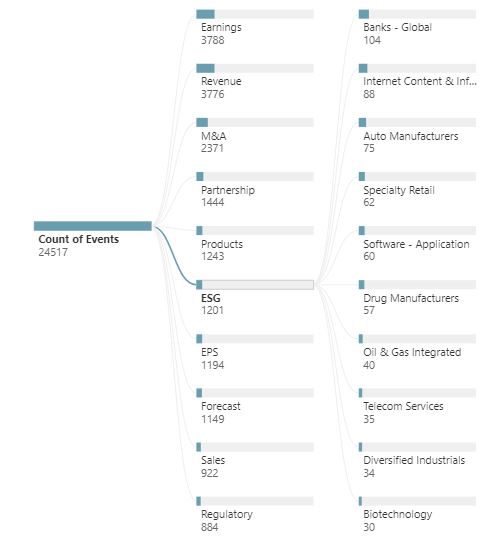

Moving dipper into industry level we found without a surprise that banks are the leader in the ESG category on the bearish side as layoffs, scandals, bribery, overcharge client’s issues were announced by every major bank in the US market during 2019.

Lastly, we list the US-traded companies with the most ESG events captured

From this chart, we see that all the big companies had ESG events during 2019 some were positive, and some were negative, for example, Amazon had more new hiring events than other firms, the company increased health benefits to their employees and reduce the environmental impact during the year.

While Johnson & Johnson, on the other hand, had been hit by product recalls, class actions, lower compensations ets…

To conclude, the ESG factor has a significant impact on the company’s performances, therefore, it is an essential element to track and process when conducting a company’s evaluation. Using NLP helps to capture and process different types of events and categories properly for future usage in the investment process.